The stock market offers shares of companies of various sizes. And industry giants are not always the best choice for a trader. Both large and small companies have their advantages and trading opportunities. In this lesson, you will learn several methods for comparing companies and their trading attractiveness.

First and foremost, you need to learn how to determine company sizes using market capitalization.

Market capitalization is the total value of all the company’s shares that have been issued.

So, the formula for calculating MC is as follows:

MC = NS * SP

Where:

- NS – the number of shares in circulation

- SP – the stock price in the market

For example, if a company has 100,000 shares in circulation at $10 each, its market capitalization will be $1,000,000.

Market capitalization shows the cost of acquiring a company at the current share price, in other words, buying all the company’s shares. When the share price falls or rises, the market capitalization becomes smaller or larger, respectively.

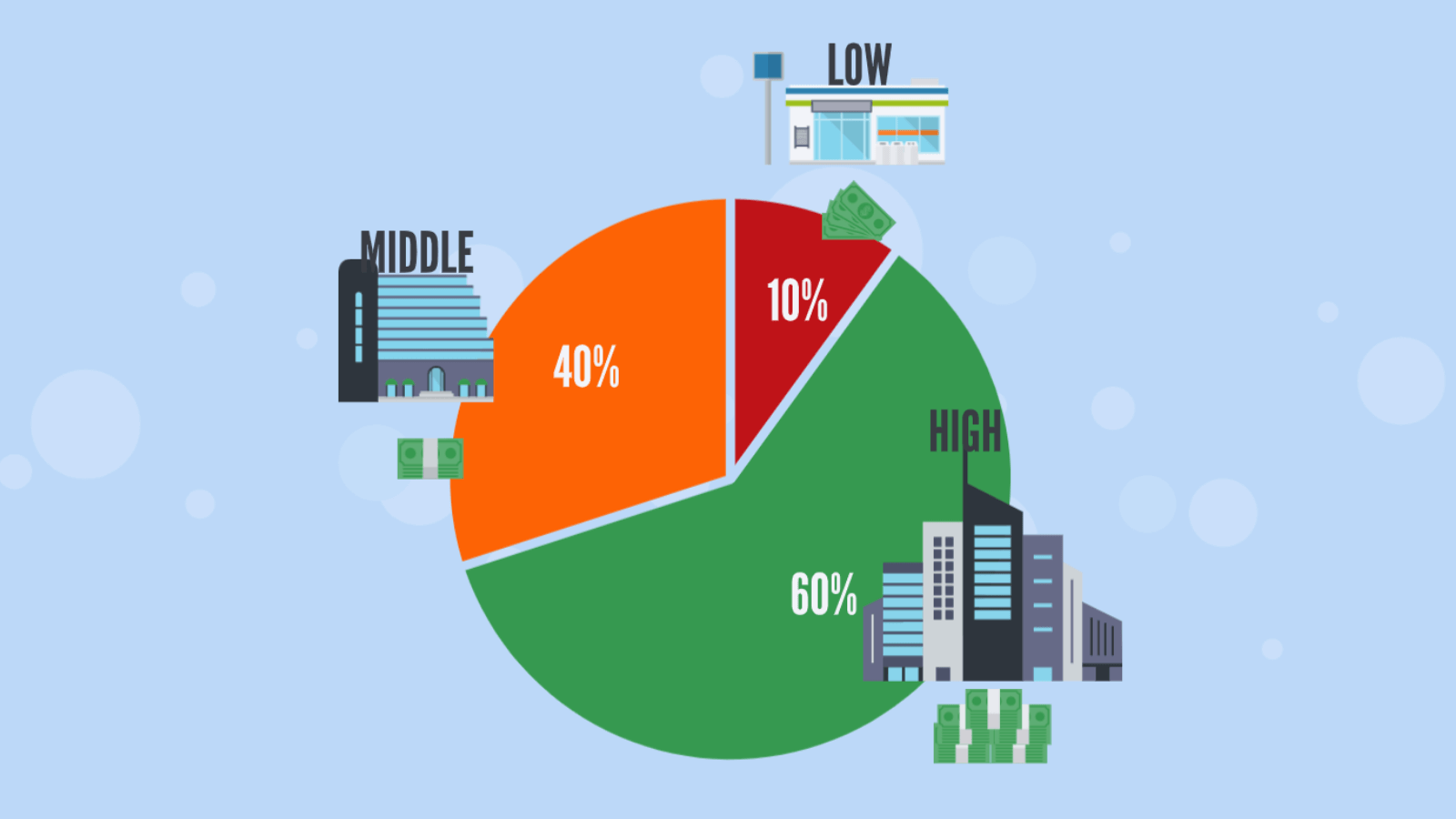

Company Groups Based on Market Capitalization

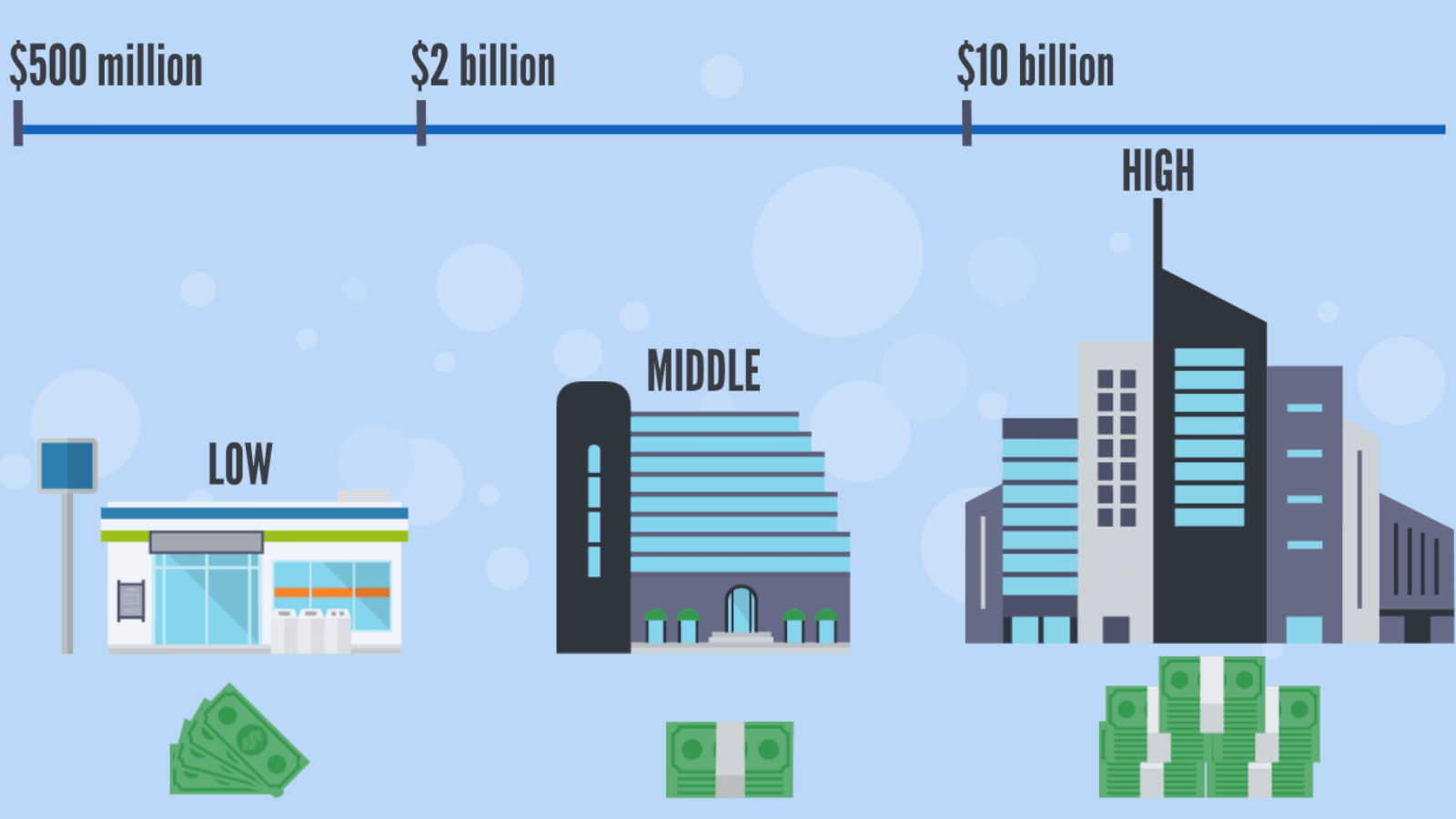

Having data on the value allows investors to group companies in order to allocate investments. They are divided into three conditional groups: companies with high, medium, and low market capitalization.

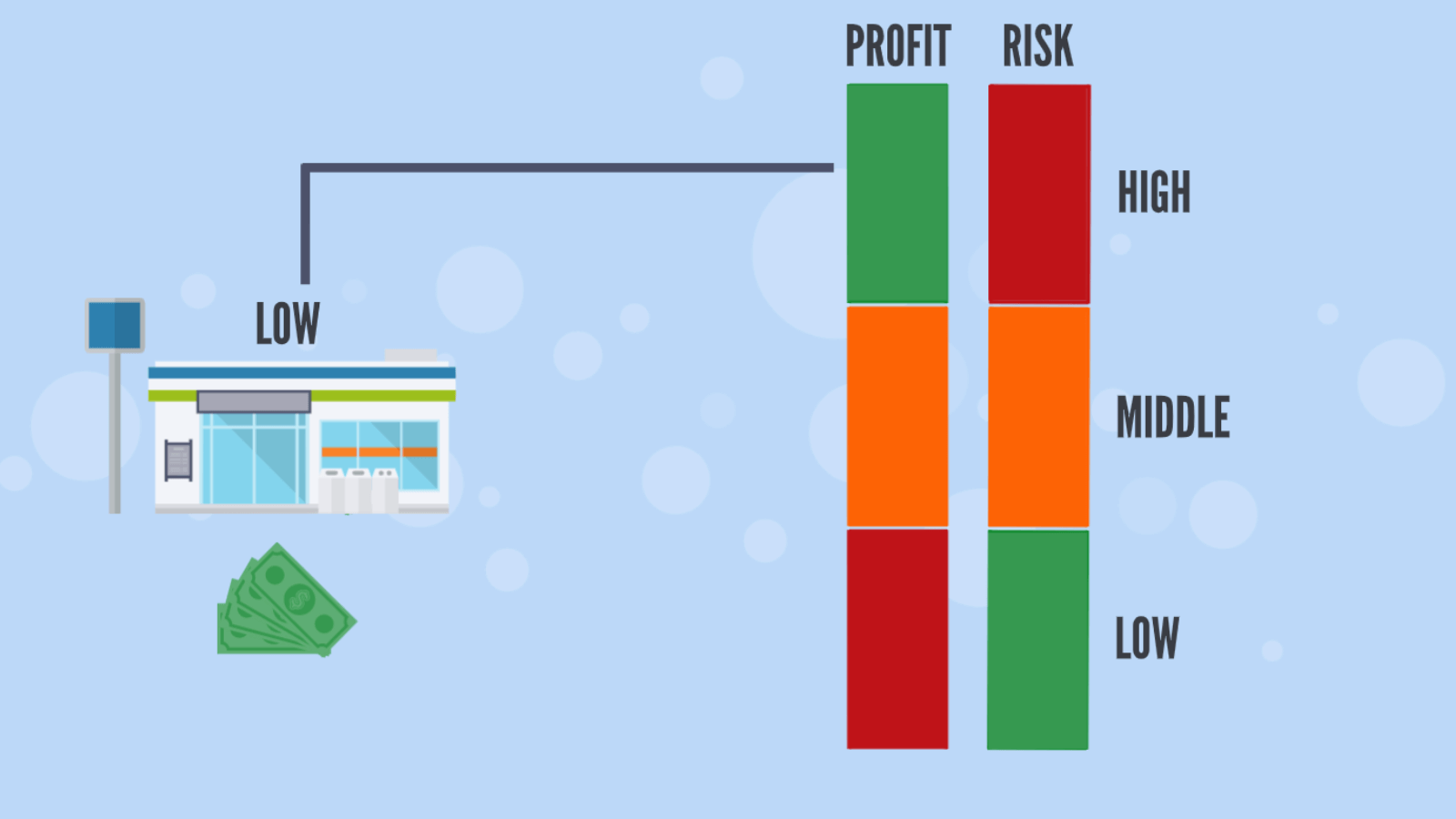

Companies with Low Market Capitalization

They most often have a market value from $500 million to $2 billion. But these values are not fixed.

Mostly these are young and little-known companies that are not closely watched.

Advantages

Companies with low market capitalization can provide good speculative opportunities, as their shares are cheaper.

As a potential for investment, new companies can outperform large ones, except during periods of economic instability.

During stable economic growth, traders pay attention to small companies. As in such periods, confidence in a successful deal is significantly higher than potential losses.

Benefit Extraction

Small companies give investors the opportunity to buy or sell shares with more intensive personal participation. For example, some fund holders can get more data about its management. They often see the fresh services and products that the company offers sooner. This involvement in the company’s work can help them predict price changes in the future.

Increased Share Price Volatility is a Signal

To more easily predict the future value of a young enterprise, it is recommended to closely monitor the liquidity and volatility (the rate of change in the share price). Suppose, if the liquidity of the company’s shares has decreased, most likely, someone has already started buying them up in anticipation of further profit. And this means that soon the number of interested traders and therefore volatility will increase.

Disadvantages

Firms with low market capitalization often imply increased risk, mainly because they are recent. Small companies have a much higher chance of going bankrupt and disappearing than large and medium ones.

Such organizations will pay investors small dividends. This happens because they need to invest profits in their own development. However, it is not to say that they do not pay dividends at all, as they need to attract new investors, payments are still made, but not regularly.

The more dynamic the change in share value, the harder it is for traders to predict and therefore earn. The low liquidity of the shares of companies with small MC indeed increases the rate of price fluctuations.

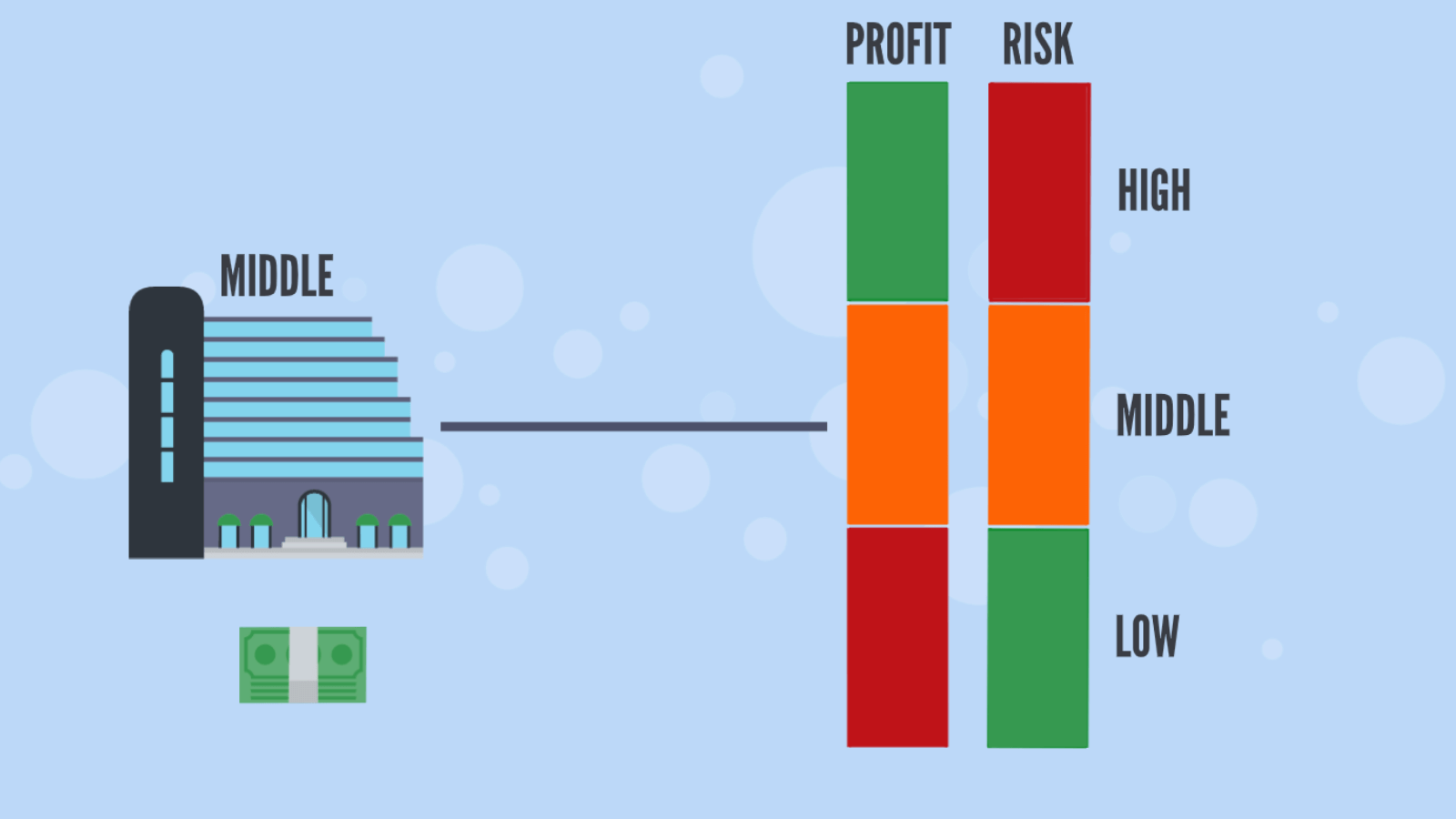

Companies with Medium Capitalization

This group includes companies with a market capitalization ranging from $2 billion to $10 billion.

Some companies from this group were previously in the high category, but for some reason, their share price has decreased. However, most still have the potential to grow.

Advantages

These companies have medium risks because the likelihood of bankruptcy and leaving the business will be less than the previous ones.

Upon reaching medium capitalization, they often receive a higher level of funding, which is a definite plus in case of a difficult economic situation.

The advantage of medium-sized companies over large ones is that they still have significant prospects for development. That is, they can grow through production or provision of services. As most large corporations have already reached their peak, they are no longer able to develop as fast.

Dividends here are paid more stably than in small firms.

Benefit Extraction

Despite the aforementioned advantages of medium-sized companies over small ones, they have not lost some of the merits of companies with low capitalization.

During economic growth, they still maintain a decent potential for development.

It is easier to evaluate the trading attractiveness of medium-sized firms, as financial and accounting reports will be simpler and smaller than large corporations. This helps to identify new products that firms are working on and make a forecast.

Medium-sized firms have more opportunities for serious funding aimed at new goods or services. That is, new products have a better chance of becoming successful, increasing the stock price in the market, and therefore, the income of fund holders.

Disadvantages

The growth opportunities of these firms are lower than those of small ones.

And although their risks are less than those of small ones, they remain larger than those of large ones. This means that serious changes in the economy can affect these firms more than large ones.

Despite the fact that medium-sized firms have advantages over large ones in growth potential, they may still be in a period of stagnation. And it can be very difficult to determine which of them will be able to develop into larger ones.

In addition, these firms have lower liquidity than those with high capitalization.

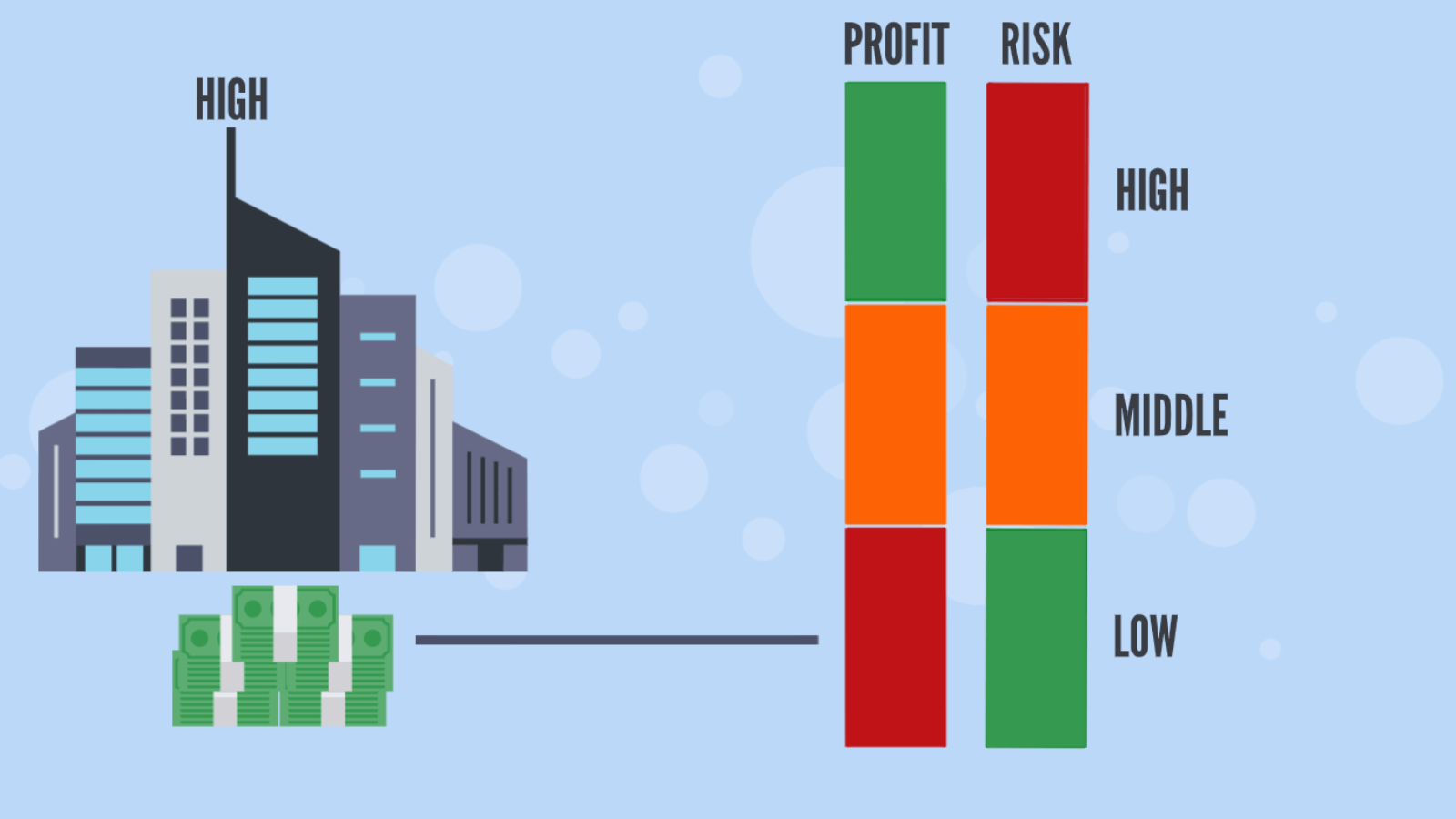

Large Capitalization Companies (Blue Chip)

This group includes companies with a market capitalization of $10 billion and above.

Advantages

Blue-chip corporations are the safest investments for stable profits, as they most often pay regular dividends.

Large firms have access to intensive financing and huge resources. This helps them remain stable in the face of changing economic conditions. During economic downturns, the number of investments in these corporations may dramatically increase. This happens because investors prefer safe investments.

Liquidity will also be higher than for previous companies. This will lead to reduced volatility and high chances of getting the value at which you want to trade.

A company of such size can invest in the development of new products that will already have a known brand behind them. Announcements about the development and release of innovative technologies or products often lead to increased interest among investors and traders.

Benefit Extraction

The large size of the company leads to increased interest. Everyone is literally watching every step of such corporations, and as a result, it is quite difficult for the trader to get an advantage in the form of information that few people know about.

Therefore, investors have to look for any trading advantages using analytics, which will help understand whether the company is undervalued.

For example, large firms regularly publish reports on their activities and profits. However, it should be understood that the reports of large companies are huge and complex, which requires investors to have considerable knowledge for effective analysis. But if the trader is experienced and knows how to conduct competent analytics, he is quite capable of finding information about undervaluation in these reports and profiting from it.

Disadvantages

Large firms have the least potential for huge growth, as they have already achieved the maximum number of customers obtained naturally.

Shares of such corporations are often reputable and popular, so their price is the highest. You are unlikely to be able to buy many such shares unless you trade CFD contracts.

Investing in such firms is still risky, as all their regalia and achievements do not guarantee that you will receive good stable profits over a long period of time.

For example, banks used to be considered high-capitalization companies with good stability. But as early as 2008, many of them quickly lost in share value, dividend payments were suspended, and their existence is now in question. This all happens due to instability in the banking sector.

Trade Distribution

If you distribute your trading volumes between companies with different capitalizations, it can help prevent the situation of “putting all your eggs in one basket”. After all, if you trade only large shares, you can limit yourself in profits. Or if you only invest in small companies, the risks will be too great.

Therefore, it is recommended to create what is called a portfolio. That is, to compose a balanced group of shares with different levels of capitalization, which will be traded and invested in.

A huge number of investors and traders say that the portfolio should include large corporations to receive regular profits. But there should also be room for small firms that have high potential and possible high profits.