The unit of price change in Forex is called a “pip”. Every new user should know what it is, as they will need to correctly calculate losses and profits. Pips are very important for creating trading plans and management. But many beginners cannot understand how this value is calculated.

The concept of “pip”

“Pip” is a slang term, most often used by traders when communicating with each other. In official sources or on brokerage websites, the word “point” is often used.

The word “pip” comes from the English acronym “PIP” (“percentage in point”). It translates as “percentage in point”.

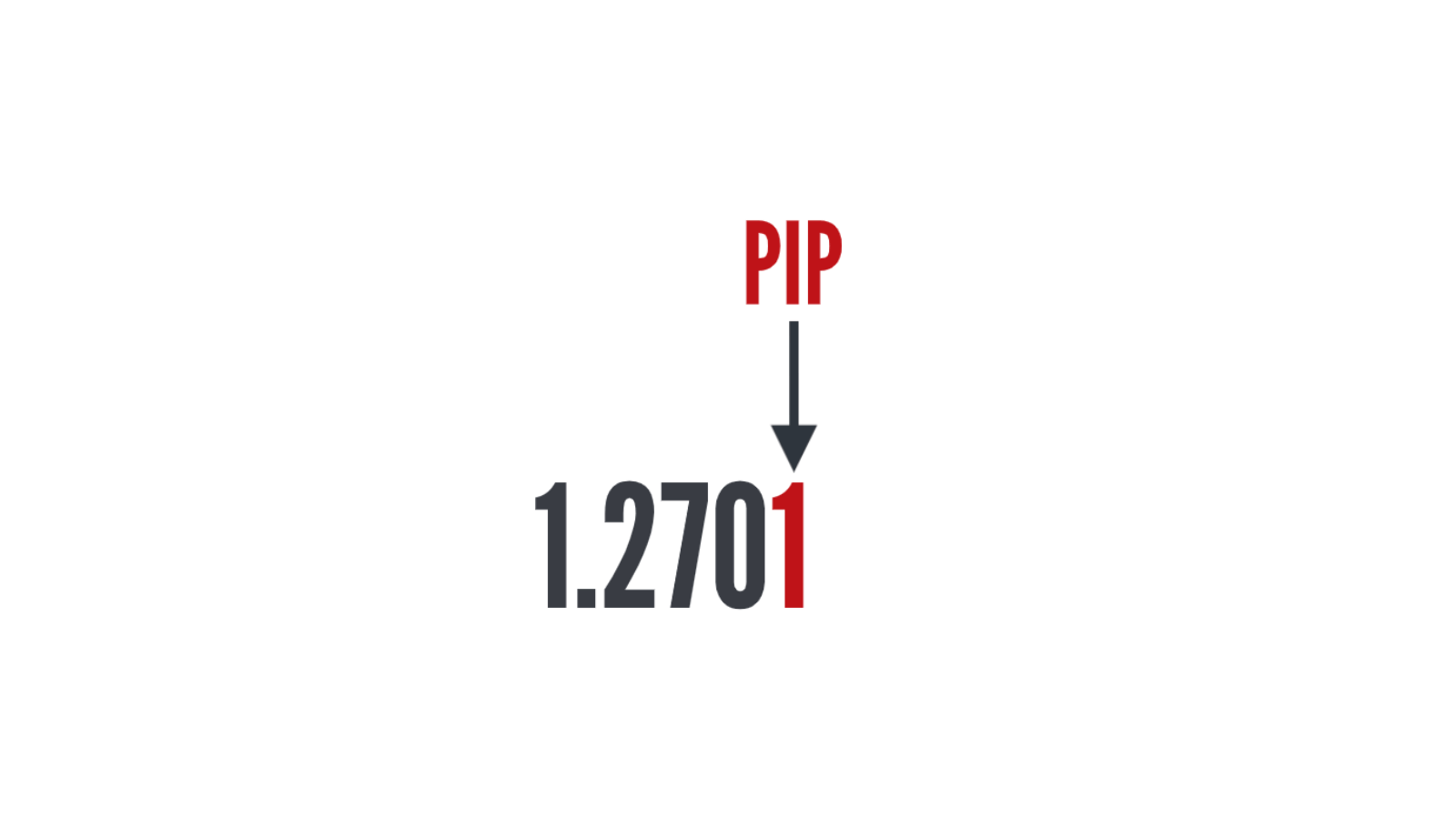

On Forex, a pip is called the minimum movement or point, which shows how much the cost will change on the financial market. In most currency pairs, the point is the fourth symbol after the decimal point in the quotation indicator.

For example, in trading instruments with yen, it will be the second digit after the decimal point. For each currency pair in each transaction, the price of a point has a different value depending on the quote, the amount of the transaction, and other factors. The price can be calculated using a trader’s calculator or in the terminal.

Why such a calculation? So that the trader can make a trading plan and take into account the potential loss or profit in it! Usually, parameters are expressed in the account currency, but the trader gets profit in points, and then translates it into currency.

Traders are recommended to calculate potential losses or profits both in the base currency and in pips before entering a transaction.

What is a tick, and how does it differ from a pip?

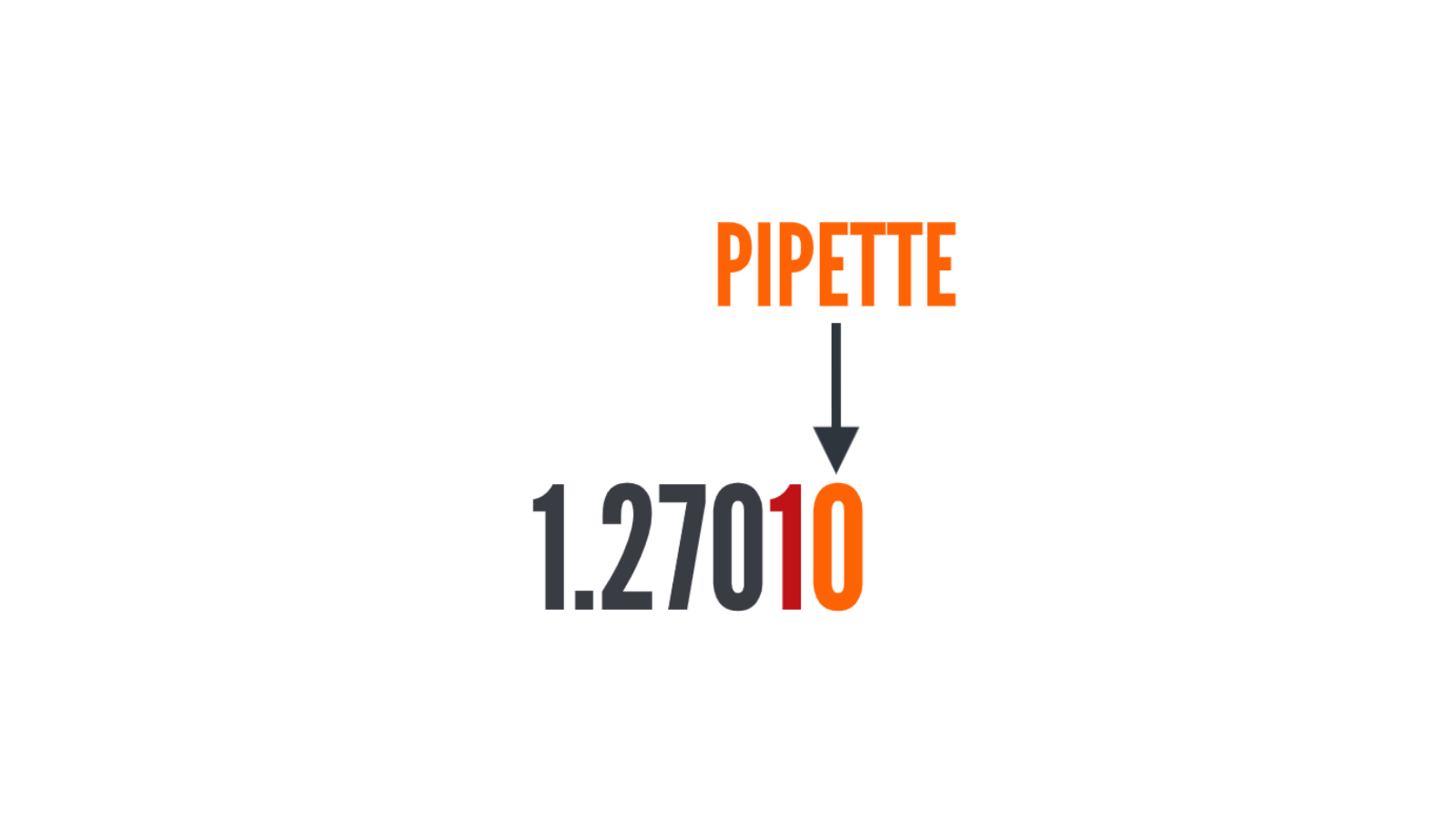

Many beginners confuse the concepts of “pip” and “tick” (or “pipette”). Sometimes brokers offer the third and fifth types of quotes, when there are 3 or 5 digits after the decimal point respectively. These decimal fractions are called ticks. For example, if an instrument with a quote of 1.62345 changed its indicator to 1.62346, it is said that the quote increased by 1 tick.

A tick in Forex is a tenth of a pip!

Therefore, if the quote has increased by 10 points, it will mean that it has risen by 100 ticks. For traders, this measurement plays a small role, so transactions are often calculated in points.

But for traders who open many transactions at the minimum price movement, tick changes will be the main source of profit.

In addition, traders can often encounter the concept of “point”. It doesn’t mean much for the currency market, but when trading on Forex, you need to know what it means. The point plays a big role for traders who trade on the stock market. Ticks and pips are numbers located to the right of the decimal point, and the point is an indicator located before the decimal point. In other words, it is a whole number.

How to calculate correctly and how much does a point cost?

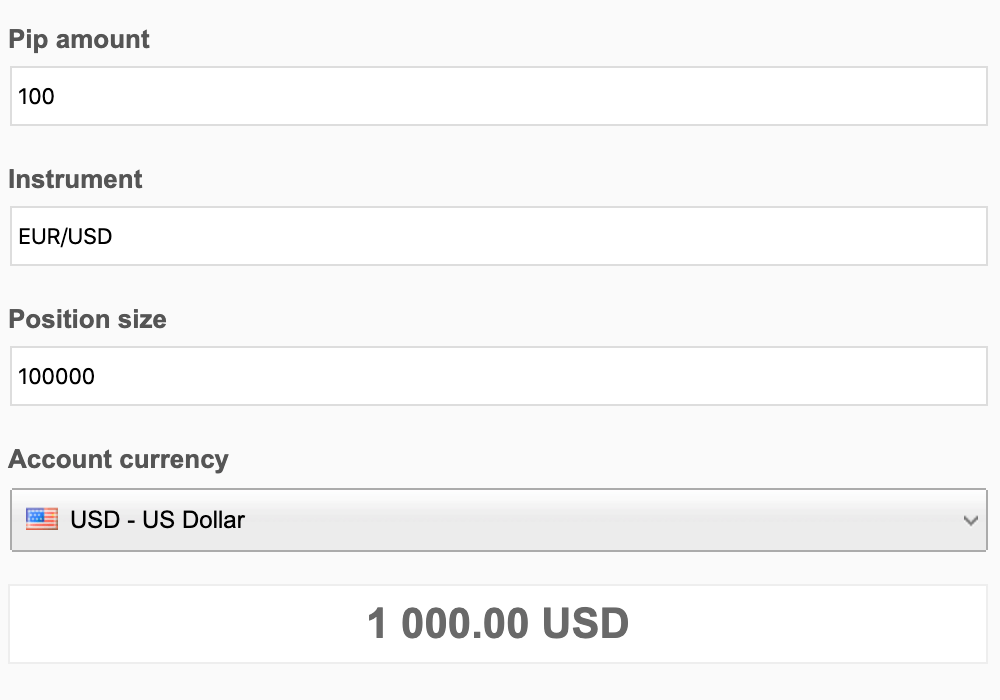

Many brokers offer a special tool on their own websites called a trader’s calculator. It allows you to calculate the price of a point in Forex. It can usually be used online. This tool also helps to calculate spreads, contract sizes, margins, and swaps.

In many Forex calculators, it is necessary to specify such values:

- Leverage

- Account type

- Account currency

To correctly calculate the transaction, you need to specify the following parameters:

- Transaction volume

- Trading instrument

- The transaction will be made for sale or purchase

- The entry and exit price of the transaction (quotes at the time of opening and closing positions)

When you fill in all the above data, you will need to click the “calculate” button to get the result for the position.

The Forex calculator is convenient to use, but some traders perform calculations manually. This is done using the formula below.

The initial data used for a sell trade:

- Pair – EUR/USD

- Position volume – 0.19 lots

- Opening price – 0.6971

- Closing price – 0.6871 (here the difference is a hundred points)

- Contract – 19,000 dollars

The result:

- (19000 * 0.6971) – (19000 * 0.6871) = 190 dollars

- 190/100 pips = 1.9

This means that the price of one point will be – 1.9 dollars.

The Forex calculator is more convenient to use because with other pairs everything may not be as easy as with EUR/USD. Other currency pairs are more complex due to the calculation of currency prices in relation to the dollar. After viewing the courses, you can make calculations without errors, but it will be time-consuming. The calculator will do it much faster.

In the terminal, all this is calculated automatically. Manual calculations and those with a calculator are used only for trading plans. During the transaction, the trader sees all these parameters on the platform.

Calculating the price of pips and ticks is important for Forex, because the trader receives loss and profit in these units of measurement, and only then in a monetary equivalent. The speculator needs to know how the price will change on the chart by formations and in numerical values. A beginner often gets lost from a huge number of numbers, but a professional trader can calculate the profit in pips and currency just by looking at the chart. These indicators are important for speculators (scalpers) who earn on minimal price fluctuations. These scalpers must quickly calculate the parameters of transactions in order to make decisions and open more positions.