When a person travels, they exchange the money of their country for the money of the country they are traveling to. In the process of this exchange, you become a participant in the foreign exchange market, as the word Forex itself means “foreign currency exchange,” abbreviated from “FOReign EXchange.” You can occasionally hear such concepts as “currency exchange” or “FX”.

The Basis of the Forex Market

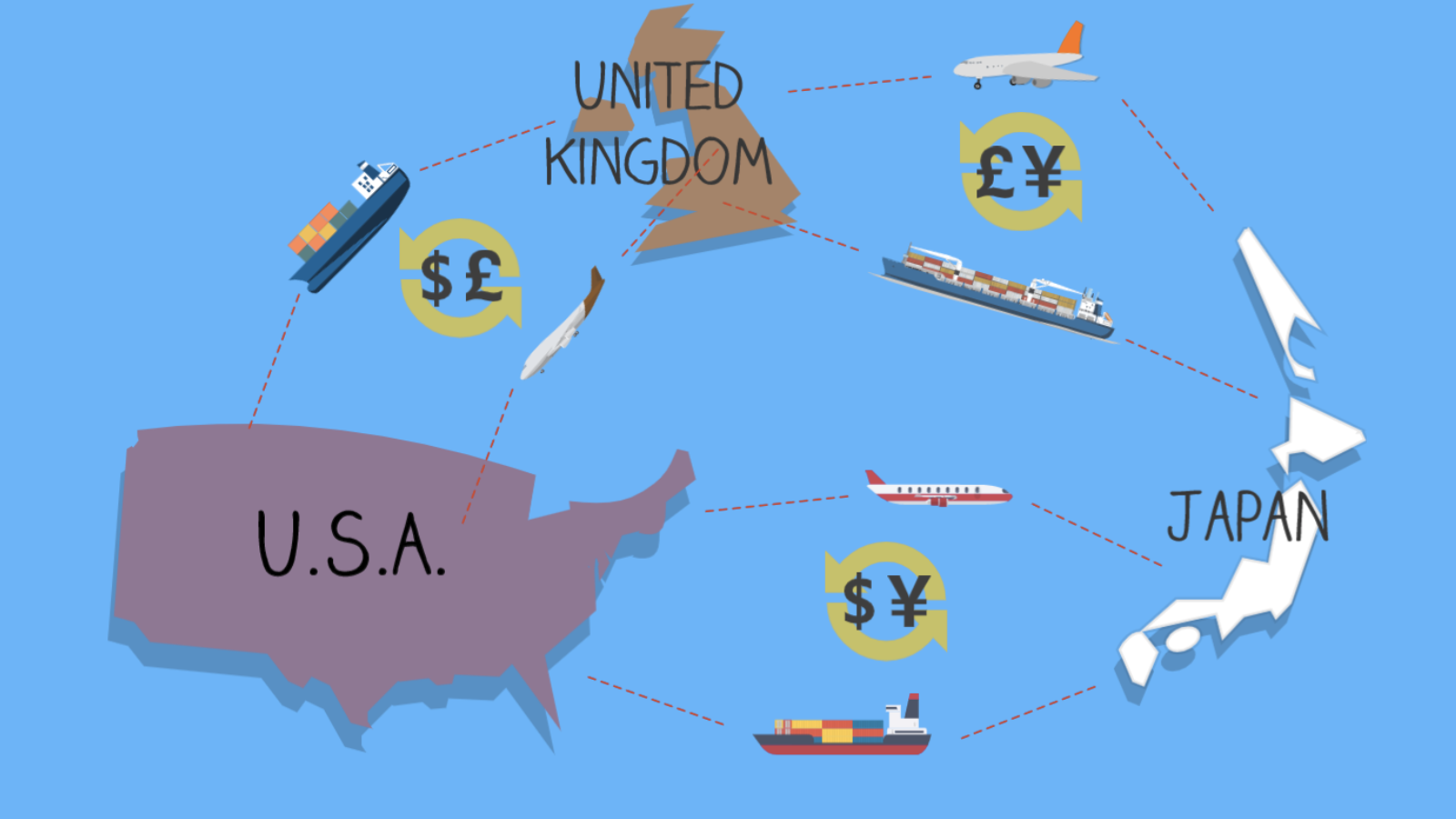

But Forex is not just a currency exchange for travel. Different companies use currencies to buy goods in other countries. To purchase goods, they must initially get the necessary currency, just like people during travel. The only difference is that companies use significantly larger amounts of money.

Due to the exchange of currencies around the world, the rate constantly changes (remember supply and demand).

Currency Trading is much like a Regular Exchange

When exchanging currency, it has a certain value or exchange rate. The law of supply and demand also works in this case and determines the value of assets.

Suppose suddenly many people needed to buy the British pound sterling. This happens, for example, when football championships, Olympics, and other global events are held. The demand for the pound increases, its value grows, and the exchange rate for other currencies accordingly too.

If at this time a person living in London is heading to New York, they need to change pound sterling to dollars. For one pound, they can buy $1.60. If they exchange 500 pounds, they will get $800.

Two weeks later, they return to London and find that they still have $100 left. In their country, the US currency is useless, so they decide to exchange it back and find that the rate is already lower and is $1.40 per pound. It turns out that the event in the country is over and the demand for currency has fallen. So, after the exchange, they got 71 pounds, instead of 62 (at the rate before departure), i.e., made a profit.

Successful trading is called using the exchange rate to make a profit.

To make it clearer, you can consider the same example, but slightly differently.

If a person exchanged 500 pounds and received 800 dollars, but returned with the same amount, then with a new exchange, they will receive 571.42 pounds. Their earnings will be 71.42 pounds, and this will happen thanks to the rate and storage of money. In the currency market, everything happens in exactly the same way. A trader buys and holds an asset until the exchange rate changes. Then they sell this asset and make a profit.

Convenient Trading for Everyone

But it’s hard to significantly boost your budget with currency exchange when traveling. There are many online organizations that help exchange currency. Such organizations are called “brokers”.

Therefore, anyone can earn on the rate. Buying assets and making a profit on the rate is Forex trading.

Online trading has the following advantages:

- To make transactions, the trader only needs an internet connection.

- Traders can use a flexible schedule, as Forex operates 24/5.

- Users can start trading even with a small initial budget.

Forex is a platform that does not bring instant wealth but can compare to the income of a working person. If a beginner is ready to learn and devotes a lot of time to trading, then over time they can reach an income level like from an average business. There are many such examples.

Of course, learning requires certain efforts. But everyone is free to choose how to allocate time for learning Forex.