Currency correlation occurs when the value of two or more currency pairs change in tandem with each other. There is a positive correlation when the value of currency pairs move in the same direction, and a negative correlation when they move in opposite directions.

Forex traders need to understand the relationship between currency pairs as correlation can impact the risks to which your trading account is exposed.

Currency Pairs Comprise Two Economies

Pairs consist of two different currencies, the value of which is calculated as a ratio of one to another. Each currency represents an economy that influences supply and demand. If the price of one currency increases (or decreases), it increases (or decreases) in value relative to other currencies (not just one).

For instance, if the U.S. dollar is increasing in value against the ruble, there’s a good chance it’s also rising against other currency pairs, not just the ruble. This implies that currency pairs cannot be traded in isolation.

However, this does not mean the price of a currency will change by the same number against other currency pairs. For instance, if the U.S. dollar increases against the ruble by 50 pips, it does not necessarily mean it will also rise by 50 pips against the Australian dollar. But its price against the Australian dollar may still increase by a certain number of pips.

Positive Correlation

The simultaneous change in the value of two currency pairs in the same direction is known as positive correlation. If the price of one currency pair rises, the price of another pair also increases. For example, consider EUR/USD and AUD/USD.

The euro and the U.S. dollar make up the EUR/USD pair. If the value of EUR/USD is rising, demand for the euro is increasing while demand for the U.S. dollar is decreasing. In any case, the euro might increase in price relative to the U.S. dollar.

If demand for the U.S. dollar decreases, it also reduces the demand for the U.S. dollar against other currency pairs. This is because demand for the U.S. dollar will be lower, and it won’t just weaken against one currency.

If the value of EUR/USD is rising because the dollar is weakening, one can expect AUD/USD to also rise. Below is a depiction of the positive correlation between EUR/USD and AUD/USD.

Negative Correlation

When the price of two currencies move in different directions, it’s called negative correlation. In such a scenario, one currency goes up, and the other one goes down. An example is EUR/USD and USD/JPY.

When the demand for the dollar increases, the value of EUR/USD falls, and USD/CHF rises. This is due to the different representations of the U.S. dollar’s value in these currency pairs. A rise in EUR/USD and a fall in USD/CHF indicate a weakening of the dollar.

Trading Multiple Currency Pairs Simultaneously

If you are trading multiple currency pairs at the same time, due to correlation between currencies, you need to take precautions.

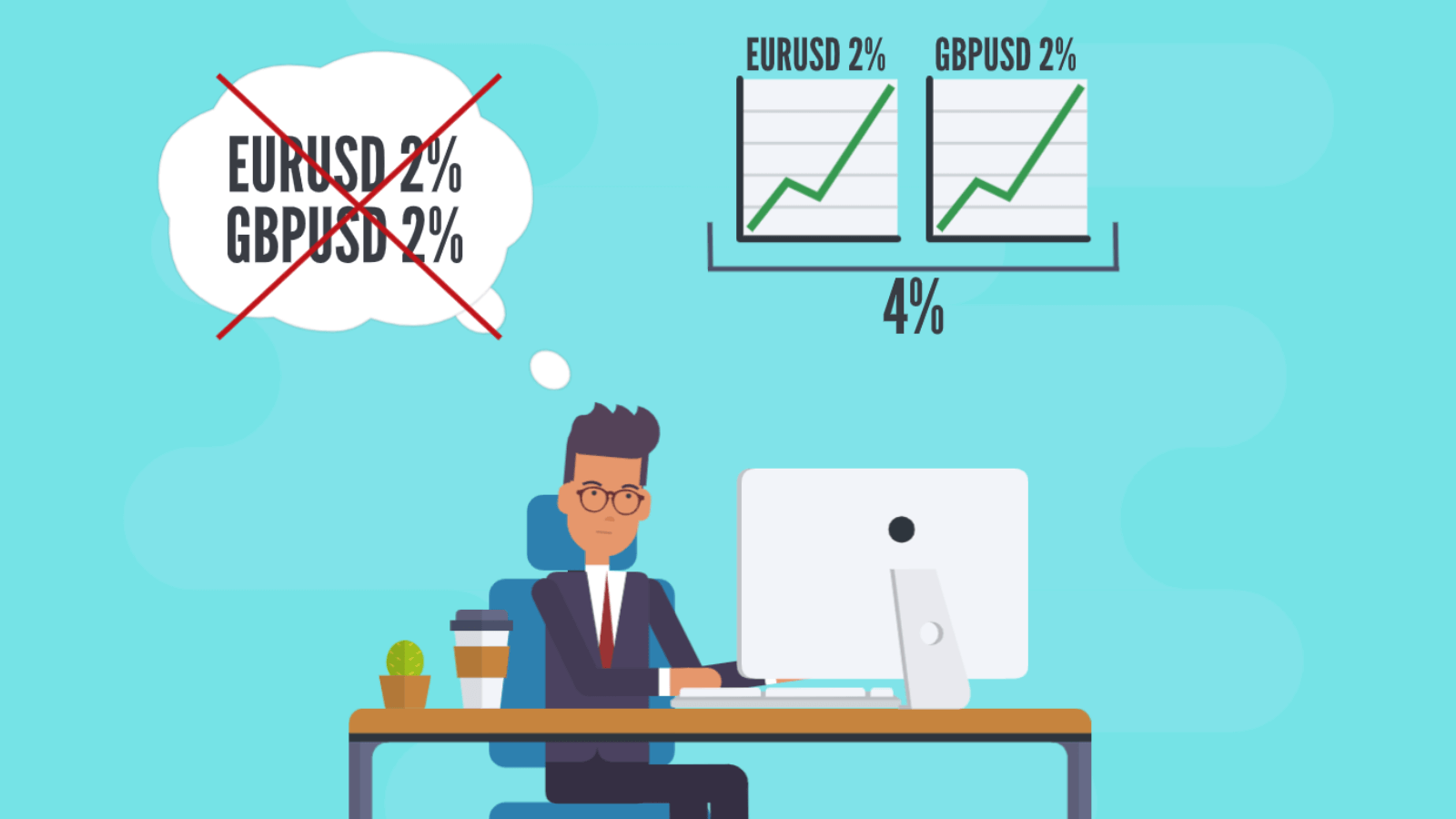

Currency correlation can increase overall risk for your trading account

Suppose you are risking 2% of your trading account on a specific trade. In the case of opening long positions on EUR/USD and GBP/USD, it might seem that you have opened 2 trades with risks of 2% for each.

But because of the presence of positive correlation between the pairs EUR/USD and GBP/USD, if the price of one of the pairs changes in any direction, the price of the other one will also quickly change in the same direction. So, if one pair moves against your trade, the other one will behave the same way. And you are already risking 4% of your account on one trade.

Correlated trades may negate each other

In the case of opening a long position on EUR/USD and short on GBP/USD, the movement in the same direction is quite possible. Then one position will be profitable, and the other will incur a loss. The profit gained in one trade is balanced by the loss in another. Opening opposing positions on highly correlated currencies won’t be productive.

If a trader opens identical positions with negatively correlated currencies (for example, EUR/USD and USD/JPY), then a profit on one position will mean a loss on another. Most often, any profit in one trade is balanced by a loss in another.

Correlations Can Be Measured

Correlations between currency pairs aren’t exact. Fundamental factors influence them. Depending on these factors, correlation may become weaker or stronger, and it can also be completely disrupted. In finance, correlations are often measured on a scale from +1 to -1.

- Ideal positive correlation = +1;

- Ideal negative correlation = -1;

- No correlation = 0.

Leveraging Currency Correlation for Profit

Currency correlation sometimes offers advantages in trading as monitoring one pair can provide insights into another pair’s behavior – but only if there’s a correlation between them.

Analyzing and Confirming Trades

Correlation can be used to confirm a trade or analyze it on an individual currency pair. Correlation isn’t exact, so you’re looking for similar kinds of changes that will vary for each pair.

This helps to determine if positively correlated currency pairs will change together with the one being observed. If you notice a downward movement, you can check if other positively correlated pairs are also moving down to confirm the accuracy of your own analysis.

For example, if you’re watching EUR/USD and you notice a drop in value, considering opening a short trade. You can pay attention to positively correlated pairs like GBP/USD and AUD/USD to see if they are also following a similar downtrend.

If they are, it’s likely that fundamental factors are influencing the movement. This makes it more probable that a new trend is establishing. A similar situation can enhance your confidence in a EUR/USD trade.

In the charts, there’s an example where three currency pairs are moving in the same direction, increasing the probability of a successful trade.

- In the first chart, EUR/USD is going down.

- In the second chart, AUD/USD is also showing a downward trend.

- In the third chart, NZD/USD further confirms the trend.

Avoiding Poor Trades

Furthermore, correlation can be used to avoid poor trades (for example, false breakouts).

If you’re watching a currency that has been trading within a certain range and then starts to rise, breaking the range, you can use positively correlated pairs to determine if they have also experienced a similar breakout.

Another example can involve EUR/USD, AUD/USD, and GBP/USD. In the chart below, you can see that the EUR/USD pair was range-bound (in a flat market) and broke out of the range, continuing to rise.

- In the first chart, EUR/USD breaks out of the range.

- In the second chart, AUD/USD moves in the opposite direction.

- In the third chart, GBP/USD fails to break out of the range.

Therefore, even with a breakout in EUR/USD, AUD/USD and GBP/USD remain unchanged. You may notice that the EUR/USD value drops fairly quickly afterwards. Hence, you can avoid poor trades by leveraging currency correlation.