When the value in two or more markets changes simultaneously, a correlation between the markets occurs. Correlation is deemed positive when the value of one asset rises and the value of another also increases. It’s deemed negative when the value of one asset rises, and the other decreases.

The underlying reasons for market correlation can vary between markets. Identifying these can provide traders with an opportunity to predict future price movements within reasonable limits.

Importantly, correlation between markets can sometimes break if disturbances arise or conditions change in the broader economic environment (for example, a financial crisis).

Capital Movement Between Markets Induces Correlation

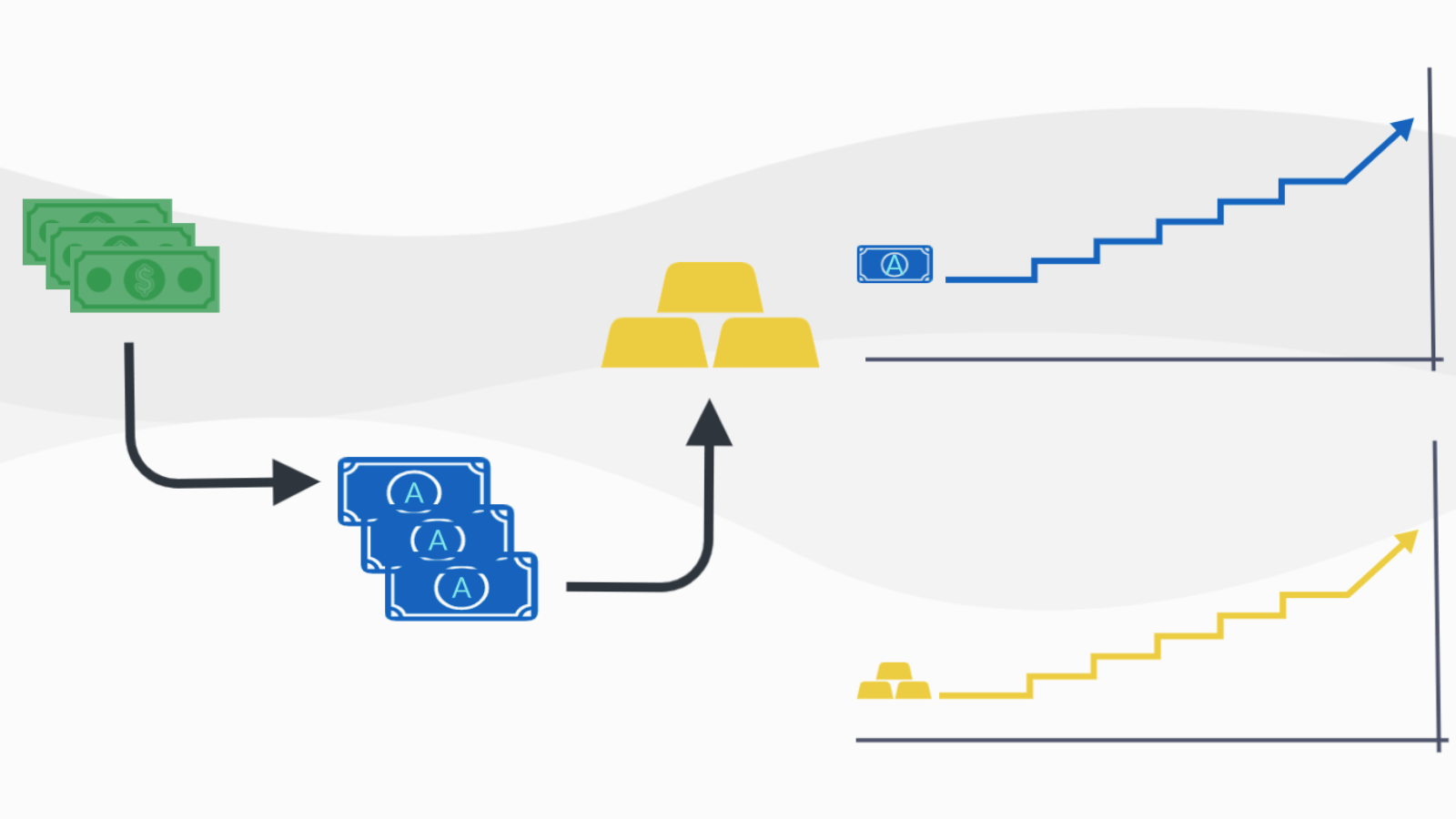

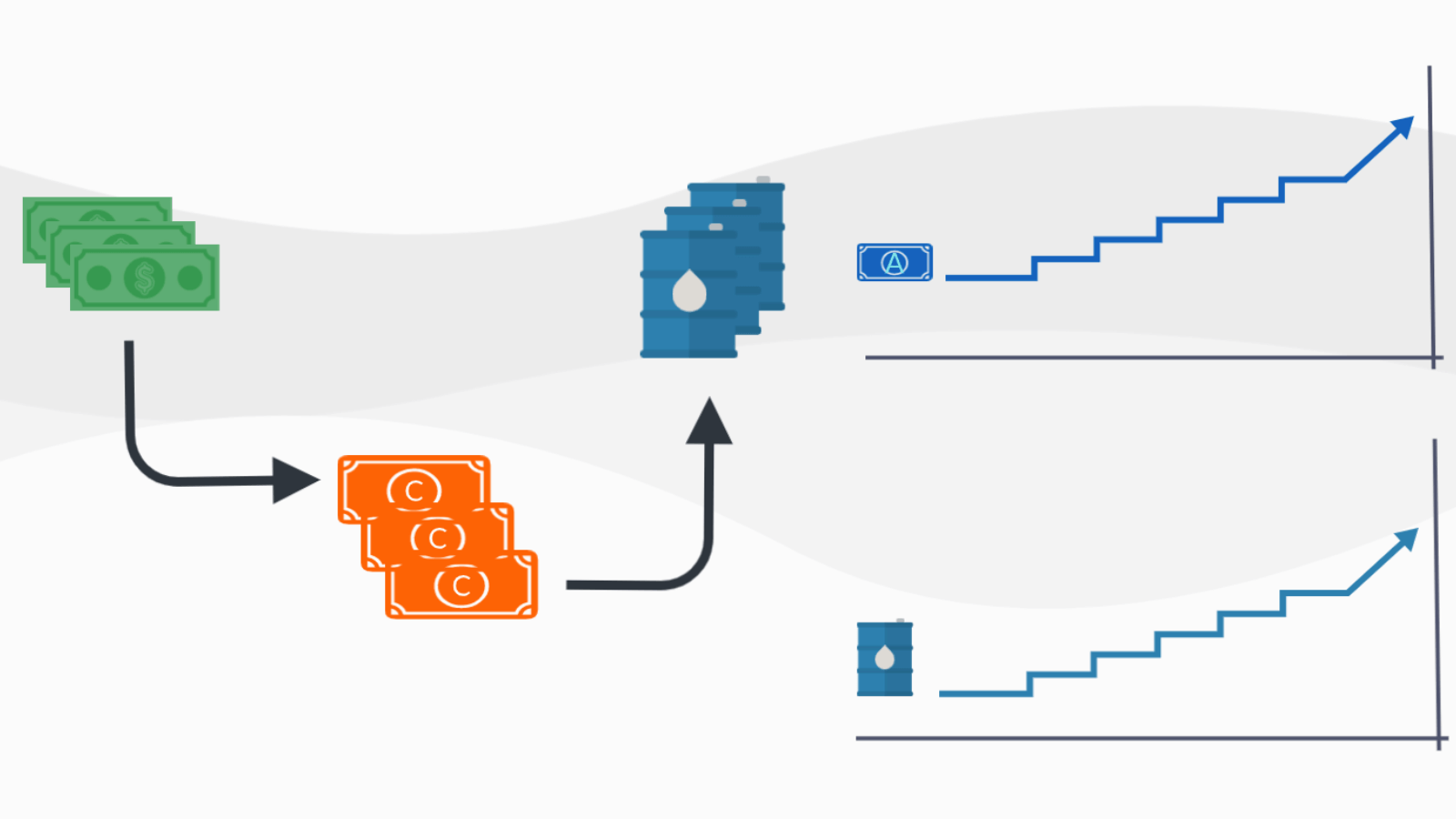

The simplest way to understand the principles of market correlation is to analyze the movement of capital between markets.

Positive Correlation Between Gold and the Australian Dollar

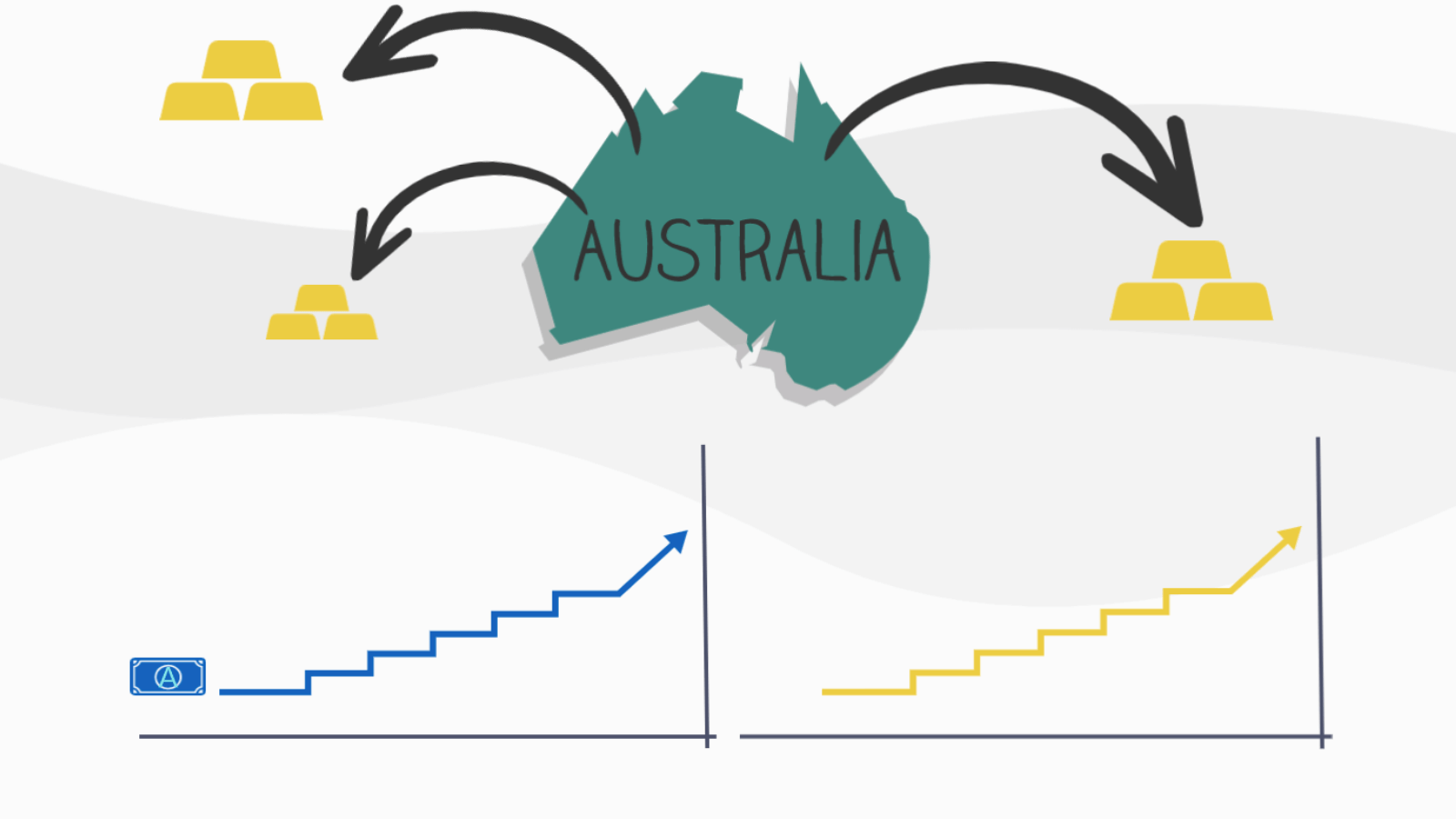

The Australian Dollar correlates well with the price of gold. This happens because Australia is a significant producer of the precious metal, which it exports to the global market. To purchase gold from Australian suppliers, the buyer must immediately convert the currency being used into Australian dollars.

If the price of gold increases, the precious metal buyer will have to acquire more Australian dollars for its purchase. This is because the demand for Australian dollars increases due to the necessity to purchase the commodity. And its value relative to other currencies will also increase. Hence, a correlation exists between gold and the Australian dollar.

Negative Correlation Between the U.S. Dollar and Gold

Under normal market conditions, investors try to find ways to earn by investing capital in financial markets (for example, stocks or bonds in the United States). Such investments are considered risky due to potential losses and volatility that can occur, but such ventures can also yield good returns.

Gold still holds value today, but investors may deem that investing in the U.S. stock market will yield more profit. This leads to a decrease in the demand for gold. Therefore, capital moves from gold to U.S. stocks. Stocks in America can only be purchased using U.S. dollars. This means that as the demand for stocks improves, the demand for the U.S. dollar will increase. As a result, it will rise in value. Hence, a negative correlation exists between the U.S. dollar and gold.

During times when the economy is unstable, investors may lose interest in risky ventures (such as United States stocks or bonds) and seek ways to safely invest capital (for instance, in gold). Investors sell their risky assets and obtain U.S. dollars to buy gold in the global market. Then, the demand for the U.S. dollar drops, while the demand for gold increases. As a result, the price of the U.S. dollar falls, and the price of gold rises.

Market Correlations Can Break Down

Sometimes, normal correlations between markets can be disrupted.

For instance, let’s look at the correlation between the U.S. dollar and gold. It seems that during economic downturns, traders and investors would seek opportunities for safe investments in gold and sell dollars.

However, in abnormal conditions, like a crisis, such market behavior can be disrupted. Economic conditions can become dire, and investors will seek safe investments in different assets, which may include U.S. government bonds and gold. To buy U.S. government bonds, one needs to purchase U.S. dollars, which in turn increases their value. Gold, being a safe investment, also rises in value as demand increases.

In this case, both the value of the U.S. dollar and gold increase. Therefore, the correlation between them is disrupted.

Using Market Correlation in Trading

Traders can use correlated markets to try to determine future price movements in one market using data from another.

AUD/USD and Gold

The example of the Australian dollar and gold shows that under normal market conditions, there is a positive correlation between these assets.

Let’s say there were several reports with bad U.S. economic data. Investors may assume that business conditions have become more difficult and withdraw capital from stock markets. Therefore, capital moves out of the stock market as investors try to find an opportunity to invest capital elsewhere.

Investors understand that gold may be in demand when they are looking for safe investments during market instability. Traders understand that if Australia is a major gold producer, its currency will rise in value to have the opportunity to buy all the more expensive gold. Traders know that most likely this will require selling U.S. dollars. As a result, the price of the U.S. dollar decreases, and the Australian dollar increases.

Ultimately, traders might look for an opportunity to buy AUD/USD.

Oil and CAD

Under normal market conditions, there is a positive correlation between the Canadian dollar and oil.

At present, the United States is the largest oil consumer in the world. Canada, on the other hand, is one of its largest exporters. The economy of this country heavily relies on America. Seventy-five percent of Canada’s total exports, including nearly all the oil it produces, go to the United States.

Currently, oil importers in the United States need to use Canadian dollars to buy oil from Canada. When the cost of oil rises, more Canadian dollars are needed to purchase it, therefore importers have to convert more U.S. dollars into Canadian currency. As a result, demand for Canadian dollars rises, demand for the U.S. currency decreases, and the price of the Canadian dollar relative to U.S. currency increases.

There can be opportunities to trade the Canadian dollar when global situations lead to a rise in the cost of oil. For instance, when a storm halts oil production in certain U.S. regions. The supply of oil drops because production has stopped. Demand hasn’t fallen, so the price of oil rises, and demand for Canadian dollars increases. Traders should then look for an opportunity to buy Canadian dollars.

Stock Markets and the Swiss Franc

Under normal market conditions, there is a negative correlation between stock markets and the Swiss Franc.

The Swiss currency is typically considered a safe haven, so during economic instability, investors seek opportunities to invest capital in the Swiss Franc rather than other currencies that are considered riskier, like stock markets.

For instance, if poor U.S. economic reports are released, investors may withdraw capital from American stock markets to invest in safe assets, such as the Swiss Franc.

If this happens, investors will be buying Swiss Francs, which will raise its value due to increased demand. And if a trader sees an economic downturn in America, they may seek opportunities to buy Swiss Francs against other currencies.