There are additional economic indicators that influence the depreciation or appreciation of a currency’s price. In this lesson, you’ll learn more about them in detail.

Unemployment Rate

The unemployment rate reflects the number of employees and workers who are unemployed but are actively looking for work.

If a report shows a low unemployment rate, investors may deem the country’s economy as robust. Therefore, they may seek opportunities to invest in that country, leading to an increase in its currency’s value. A country with a rising unemployment rate could be seen as having a weakening economy, leading investors to seek investment opportunities elsewhere, causing the currency value to drop.

Gross Domestic Product (GDP)

GDP indicates the total amount of spending by investors and consumers, country’s expenditure over a specific period, and international trade. Essentially, it measures the total production of goods and services within an entire country. GDP is often measured quarterly or annually.

If the growth rate of the GDP is high, the economy can be considered strong, and the currency usually appreciates. If the GDP growth rate declines, it can be seen as a sign of a weakening economy, and the currency depreciates.

Economic Growth Forecast

Government agencies, economic research institutes, and investment banks release growth forecasts. This GDP forecast is made based on their assessment.

This is one of the indicators of economic strength for traders and investors. Forecasts influence the currency price at the time of publication. Most often, the GDP is estimated for two years, not one. If the forecasted growth decreases, it negatively impacts the currency price. If it increases, the impact is positive.

Retail Sales

Consumer spending can be considered the main part of the economy. Even if it’s not, it still makes up a significant portion of it. Therefore, retail sales data are considered an important indicator. Retail sales reflect the total amount of consumer spending in a particular month across various sectors (such as electronics retail, restaurants, auto dealers).

Stable growth in retail sales indicates that consumers have confidence in the economy, and they have extra income to spend on goods and services. Therefore, an increase in retail sales has a positive impact on the currency.

Housing Sales

The housing market is one of the most noticeable signs of steady economic growth. Housing sales are measured as follows:

- Sales of new homes;

- Pending home sales;

- Starts of new home construction;

- Building permits

Each of these housing sector reports changes depending on consumer confidence, overall economic stability, and mortgage interest rates. Housing sales figures are a clear indicator of economic strength. Therefore, positive housing sales data positively impact the currency.

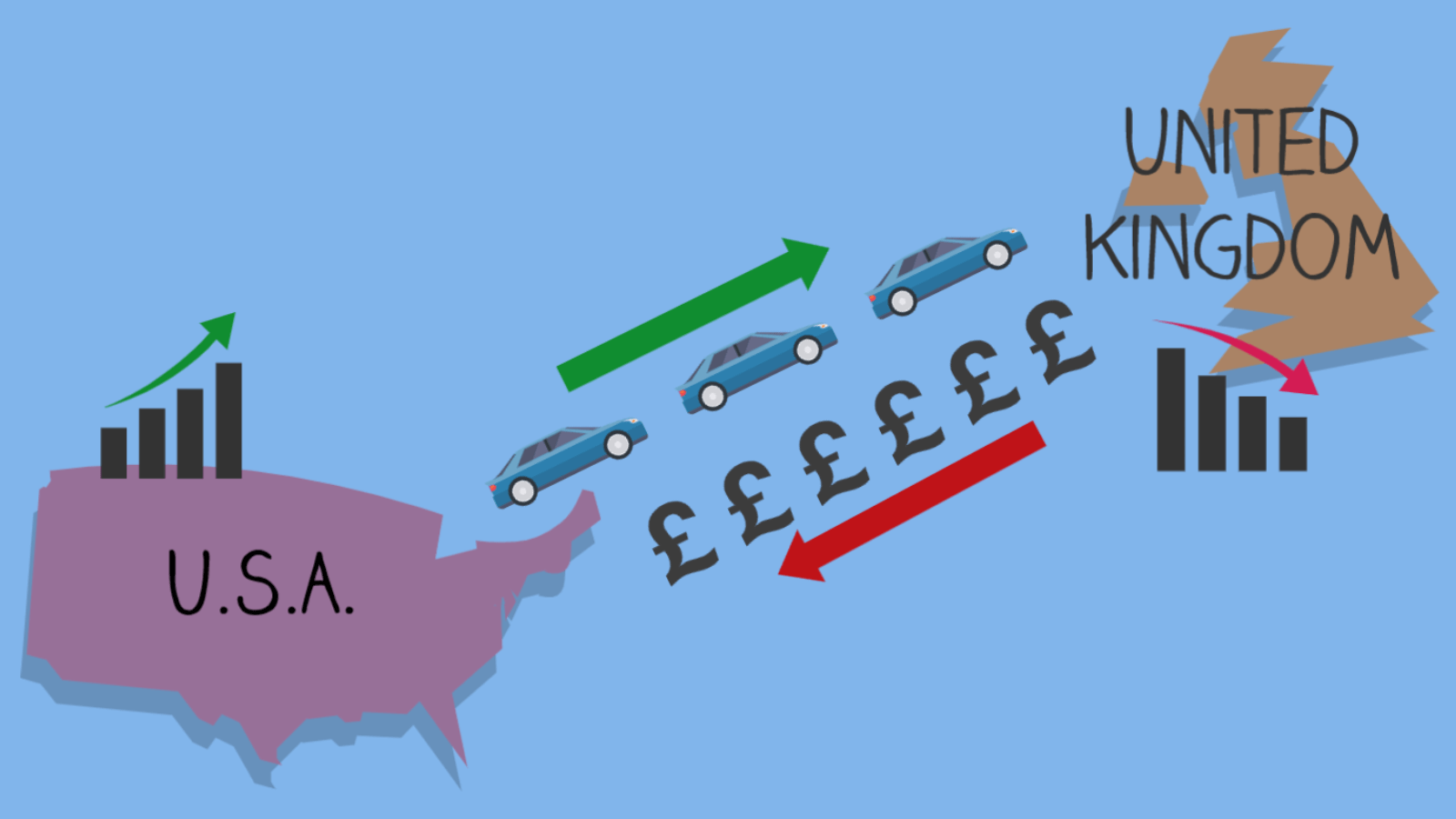

Trade Balance

The import and export of a country over a specific period are compared in the trade balance. A country will either have a trade surplus or a trade deficit. A trade deficit is when import exceeds export. Conversely, a trade surplus is when export exceeds import.

A trade deficit lowers the currency’s value since more foreign goods are being imported than exported. Thus, the local currency must be converted into the currency of the country from which goods are being imported.

A trade surplus can have a positive impact, as foreign currency is converted into local currency to purchase exported goods and services. Hence, the demand for the local currency increases.

Changes in the trade balance are crucial

When considering a country’s trade surplus or deficit, it’s important to note whether the figures are changing from the last published report. This also affects the currency. If a country’s deficit is increasing, the amount of local currency needed to convert into foreign currency to buy goods and services also increases.

Therefore, an increase in the trade deficit leads to more significant devaluation of the currency than a standard deficit report. The opposite happens when a country’s trade surplus is increasing.