Once it is well understood what stocks and funds are, the question becomes logical – how to trade them? Everything depends on how active a trader or investor you will be.

Those wishing to acquire and hold shares for several years can use a bank that provides such an opportunity. In this case, you will have to pay a double commission – the first when buying shares, and the second when selling them. It turns out to be quite expensive, but if the price of the purchased shares increases significantly, the income will significantly cover the commission costs.

Online Brokers for more Active Trading

If you want to sell and buy shares quickly and take advantage of all the benefits of a short-term perspective, this method will not suit you. After all, commissions are charged for each trading operation, the size of which will exceed almost any return.

For those wishing to be more active in the markets, the best solution is trading through online brokers (or trading platforms).

The process is simple, with a trading platform you place an order with a broker. The trading platform is software that will execute your sell or buy order.

There are Two Ways to Trade Stocks

Trading methods have changed significantly recently. In the past, the only way to trade stocks was to get a real share and own it until it was sold.

Now there is another way to trade – use contracts for difference.

A contract for difference, also known as a CFD contract. It provides an opportunity to profit from the same price movements, but you will not receive shares in ownership.

A CFD is an Agreement between a Seller and a Buyer

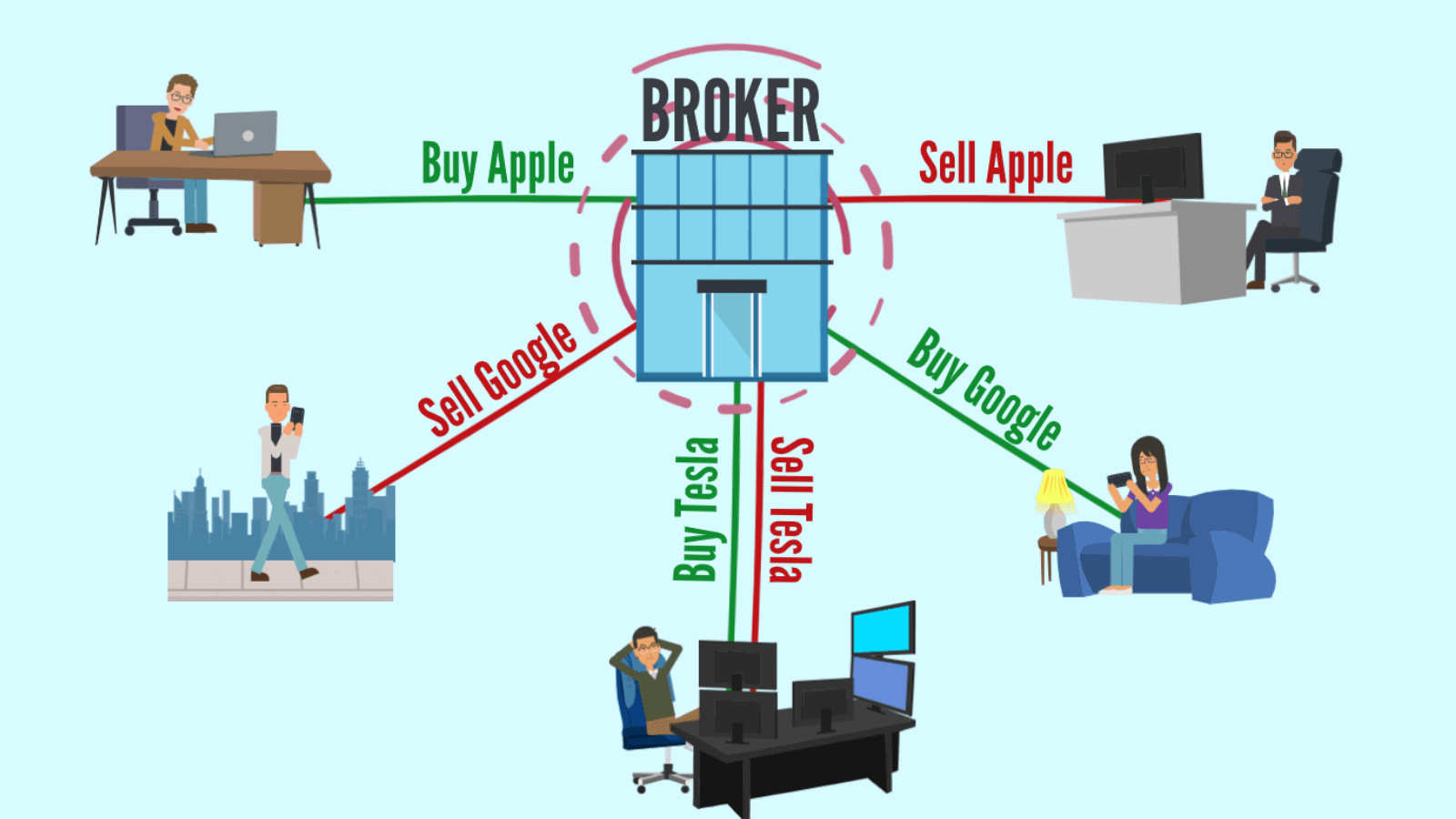

A contract for difference is essentially a regular bilateral agreement, where on one side is the buyer and on the other is the seller. Mostly the first side is the trader, and the second is the CFD provider or broker.

This is somewhat similar to a dispute about where the price of a stock will go.

Let’s say you are sure that the cost of Apple shares will increase in the near future and you open a buy order. The trading platform instantly looks for a trader with an opposite request (for a fall in shares) and automatically concludes that same CFD contract between you. Since the broker is obliged to provide liquidity to its traders, he can act as the second party to the deal.

Apple’s stocks have risen, and you decide to sell them, closing the deal. In this case, you would gain a profit in the form of a payout from the counterparty. If the funds fall in price, you pay the counterparty their profit, as they had opened a contract for a decline.

The actual stocks are not transferred in trading, which is one of the main advantages of contracts for difference. For instance, transactions are instantaneous, and you don’t need to possess a large amount of capital to start trading.

This is quite a coarse description of CFD technology, as there are also such factors as transaction volume, leverage, closing/opening prices, etc. But at this stage of learning, this is quite sufficient.

The Base Stock determines the Price of the Contract for Difference

The actual cost of the stock determines the price at which the CFD contract will be concluded. At the same time, you should remember that you do not acquire the stock and cannot trade it.

The price when trading CFD shares equals the cost of the stocks. They cannot be traded separately.

Leverage

In addition to speed and convenience of trading, CFDs have another significant advantage – the presence of leverage.

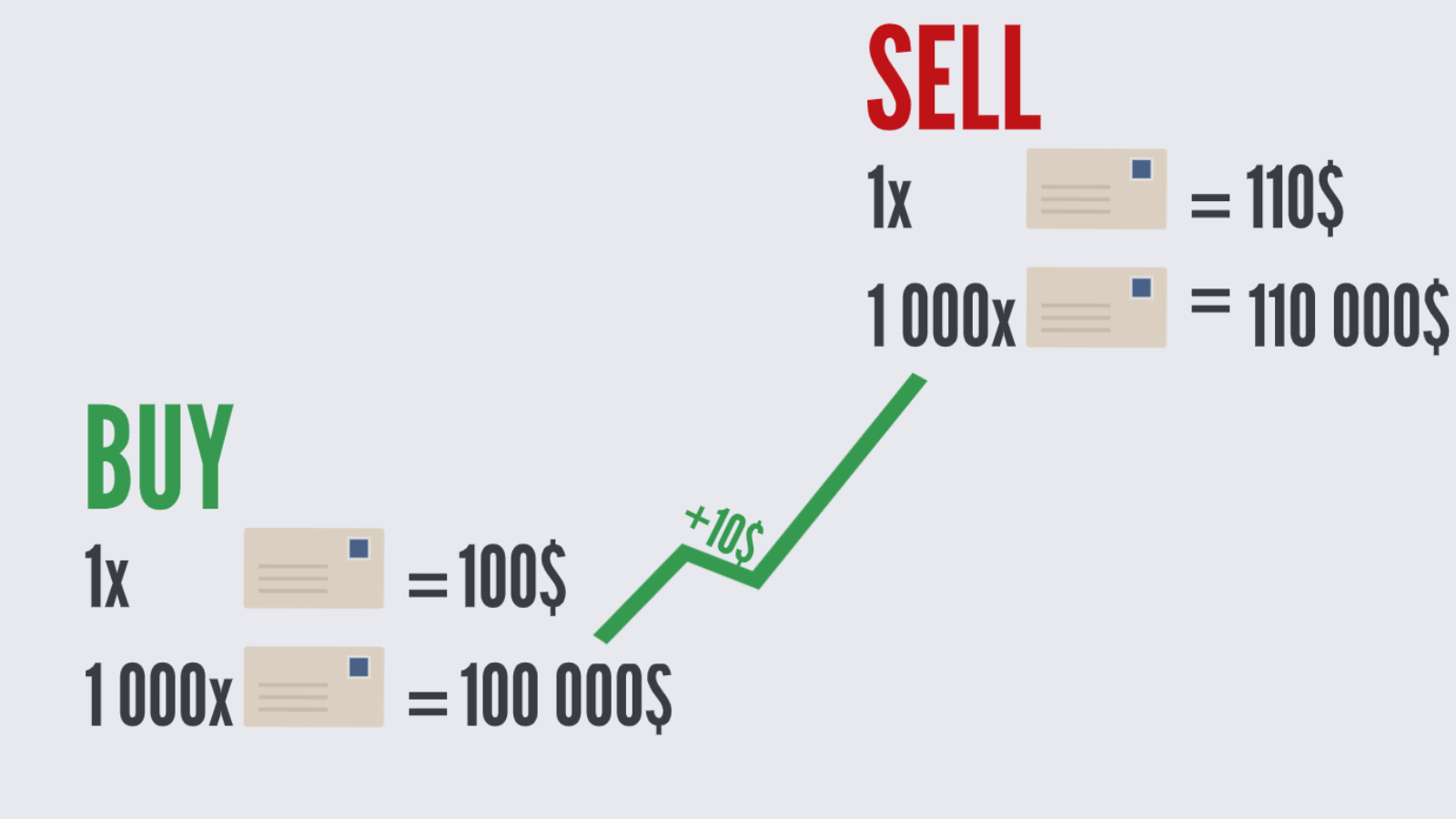

When buying a stock in the traditional way, you need to have a certain amount of funds for the transaction, often quite large. For example, if one fund costs 100 dollars and you would like to buy 1,000, then you should have 100,000 dollars in your account.

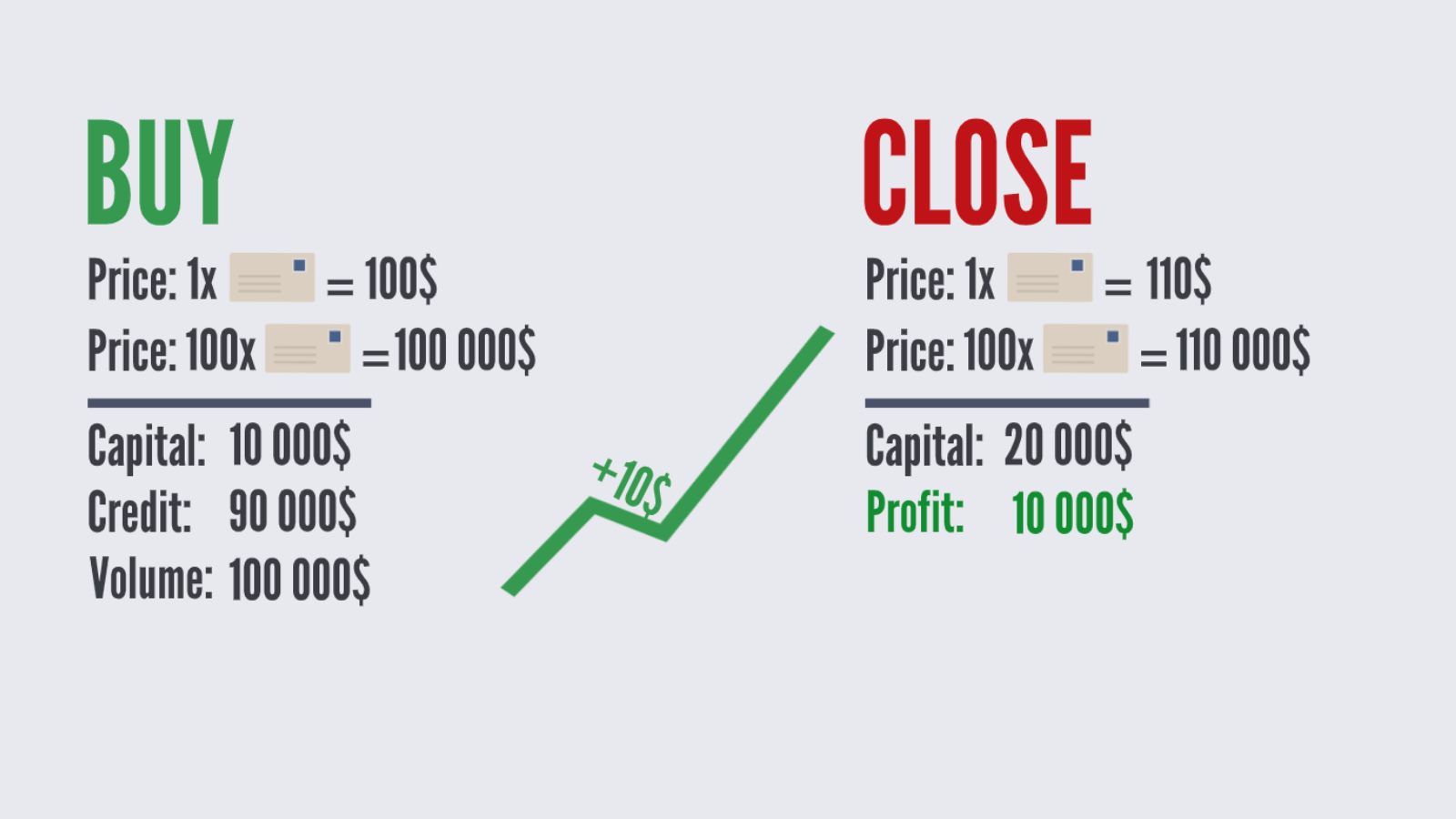

If the funds rise in price by 10 dollars, then the total cost will be 110,000, and you will get a profit of 10,000 dollars. But for such a deal, you need to have the same 100,000, which most beginning traders do not have.

Leverage allows you to trade larger volumes, gaining more profit, while having significantly fewer funds in your account. This is achieved through the issuance of loans by brokers for the duration of the deal.

Let’s consider the same example: to buy 1,000 shares for a total cost of 100,000 dollars, you should have only 10,000 in your account. The broker will provide the remaining 90,000 as a loan. As soon as the funds rise in price by 10 dollars and you sell them for 110,000, the broker immediately returns their 90,000. You will have 20,000 dollars left in your account (10,000 initial account and 10,000 profit).

Such leverage is denoted as 10:1 or 10%. That is, you need to have 10 percent of the total cost in your account to conclude the contract.

Obviously, this mechanism allows you to earn significantly more than your capital would allow in traditional stock trading.

The Flip Side of Leverage

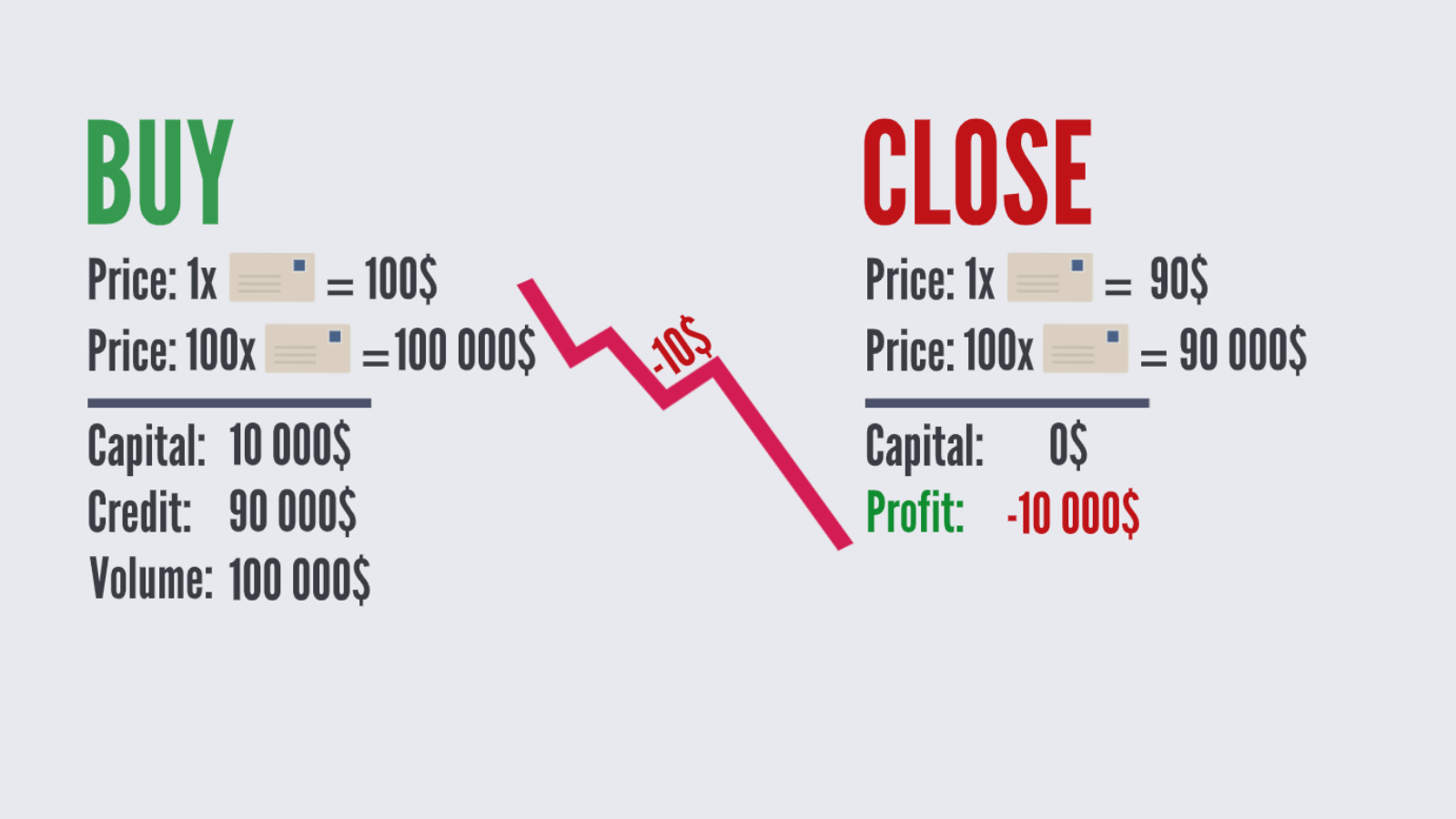

Every trader should remember that losses can likewise be higher. If the shares fall in value by 1 dollar, you will lose 1,000 dollars, and your capital will amount to 9,000 dollars. In this case, you lose 10 percent of the account.

To prevent the so-called “blowout” (loss of all capital), there are many capital management techniques. For example, the obligation to risk no more than 2 percent of your capital in a single transaction.

Trading Costs

Whether a purchase is made traditionally through a bank or using contracts for difference, in any case, you will have to pay the service provider’s fees in the form of commissions.

Commissions and Spreads

All companies offering CFD trading services charge spreads on each trading operation. A spread is the difference between the asset’s purchase price and the sale price. The closest analogy is the earnings of currency exchanges on the difference in the purchase and sale of the asset.

Overnight (Swap)

When trading CFDs, you will have to pay for all open long positions left overnight. Most often, payouts are based on interbank loan rates or LIBOR. But sometimes they will be set by the broker himself.

If you have an open short position, you are usually paid at the loan rate. But only if it is not too low.

The Trader receives Dividends for the Contract for Difference

When trading CFD shares, you get the right to dividends if you have a contract for difference the day before the dividend date. When you acquire a package of shares (contract for difference to this day), you gain the right to payouts. You can always find the date on the website of the company whose shares interest you. It is usually on the investor relations page.

To receive dividends, you must have an open position. The amount will be paid for any share in your possession. For example, if you own shares of a company paying 0.10 dollars per share every quarter, you will receive 0.10 dollars per share.

The actual date of dividend payment will be the main one. For a contract for difference, the payout process is often simpler than for stocks. Dividends on shares can be paid weeks after the ex-dividend date. But for CFDs, you will receive them the next day.

The Trader is Obliged to Pay Dividends for Short Positions

If you have an open long position, you get the right to dividends in the case of owning CFDs for 24 hours before the ex-dividend date. But you have to pay the dividend amount yourself if you have an open short position.

Remember that open positions compel you to pay this amount. If you have an open short on a company’s shares (which pays dividends), the dividend amount will be charged for all your shares.

You must pay dividends, but you do not have the rights that the owner has. For example, a shareholder can attend shareholder meetings or vote, but the owner of a contract for difference cannot.

Traditional Stocks vs CFDs

The trader decides for himself whether to engage in traditional stock trading through a bank or using CFD contracts. Each type of trading has its advantages and disadvantages. For instance, if a trader holds a position for a long time, they may decide to buy a real share, as it has its financial backing.

The process of opening shorts with CFDs will be much easier than a similar process with stocks. This is because, in the former case, the agreement will be made between the broker and you. In the case of selling shares, the company will have to give you real shares to sell in order to buy them back at a lower price later.

Financial regulators can periodically ban the opening of shorts on stocks. Everything depends on the regulator’s conditions. Shorts on CFDs are almost never threatened with such a restriction.

When using a contract for difference, you can benefit from increased profitability, as you have access to leverage.