The stock market is a huge segment of financial trading. Billions of dollars are turned over on this market every day. And traders are directly involved in this turnover, selling and buying company shares.

But what are stocks and funds? And what is the stock market?

A Stock is a Unit of Company Ownership

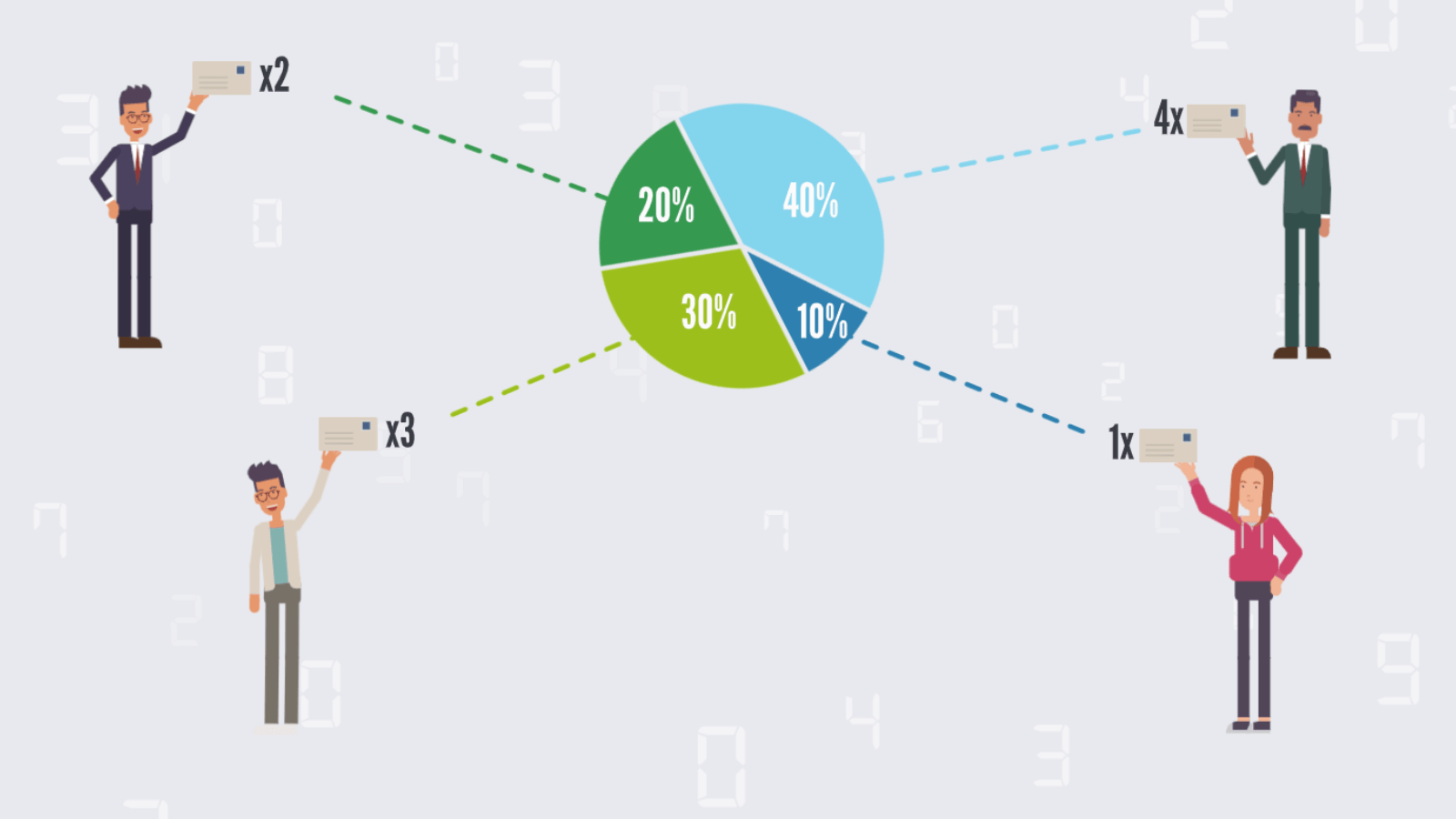

When buying a stock or security of a company, you acquire a unit of its ownership. This means that companies that allow their own shares to be bought are called public companies. Because they are owned by the public.

By owning just one share of a public company, you are already considered a shareholder. Accordingly, if you have more shares of this company, you will own a larger part.

There are different types of shares that you can purchase. Each type has its own characteristics, advantages, and opportunities.

The Aim of Buying and Selling Shares is to Make a Profit

The main reason why stock trading takes place is the opportunity to earn income. Since part of the company’s income is distributed among shareholders, some buyers buy shares in order to receive dividends. Others buy them with the expectation of subsequent sale when they appreciate.

In the case of an increase in demand for securities, their value will also increase.

There are many reasons for an increase in demand, but let’s look at an example.

The purchase may give the owner an advantage (say, in the form of dividends), so there is a certain demand for them.

In the event of a company’s prosperity and an increase in its profits, dividends will also become larger. More people will want to buy shares, which means their value will increase. This scenario for increasing demand is one of many.

What is the Point of Buying and Selling Shares?

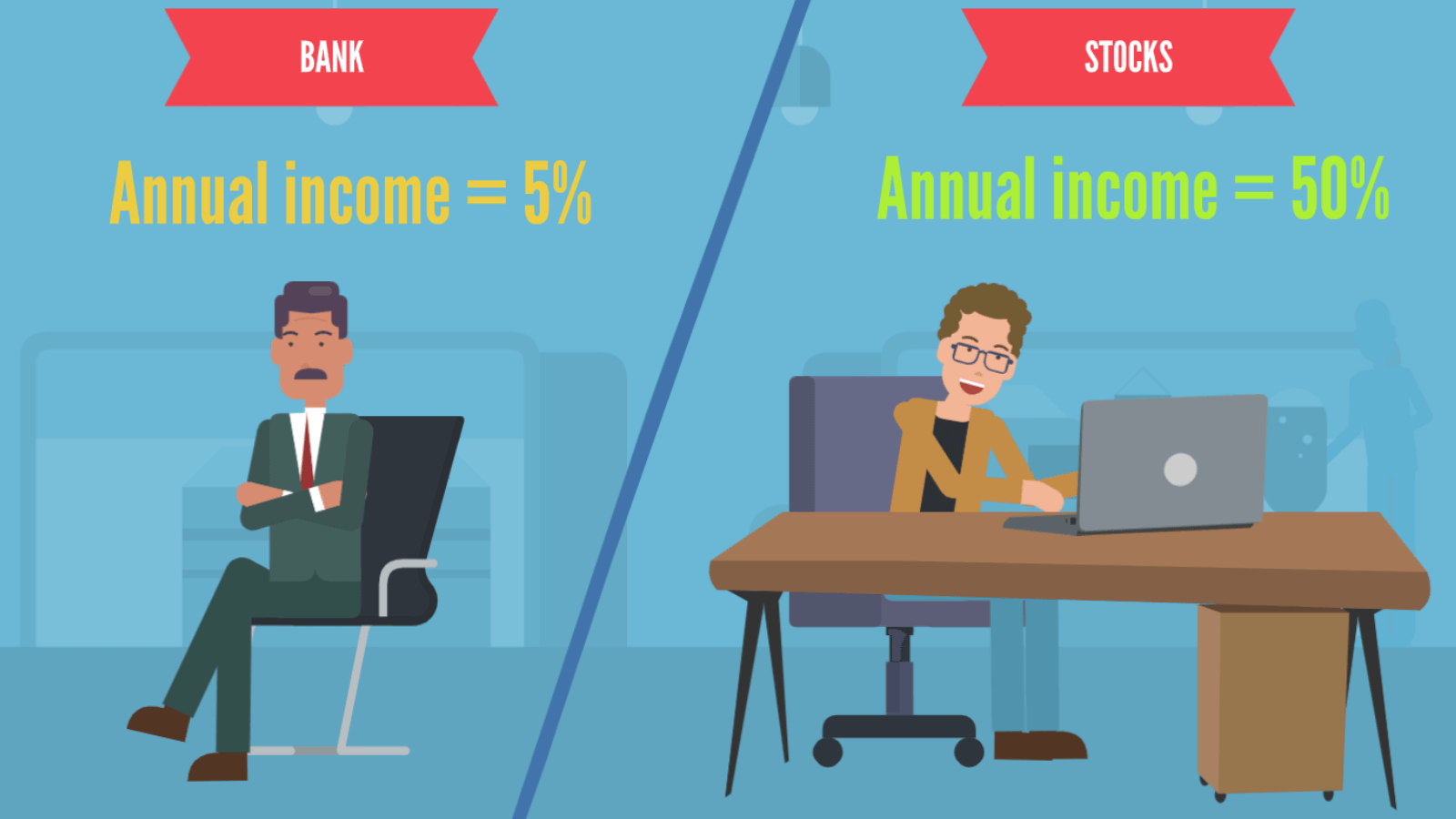

The sale and purchase of stocks and bonds are riskier than holding savings in a bank account for accumulation. But in the long term, it can bring significantly more profit.

Let’s compare:

Take the usual annual rate for European banks for savings accounts – 3 percent. No, let’s take a raised rate of 5 percent, which not everyone is offered. That is, the maximum you can count on with $1000 is $50 after a year. And if you invest in stocks, for the same year you can get a profit of $500 (50%). But this is in the case of a competent approach to choosing stocks, as you can just as well incur losses.

Usually, stocks outperform fixed-income goods (for example, bonds). When buying the FTSE 100 index (the largest index of the UK stock exchange), you can earn from 5 to 15 percent per year, if you manage to hold it for a long time.

In the same way, you can achieve good results by investing in a well-diversified portfolio.

Stock Trading

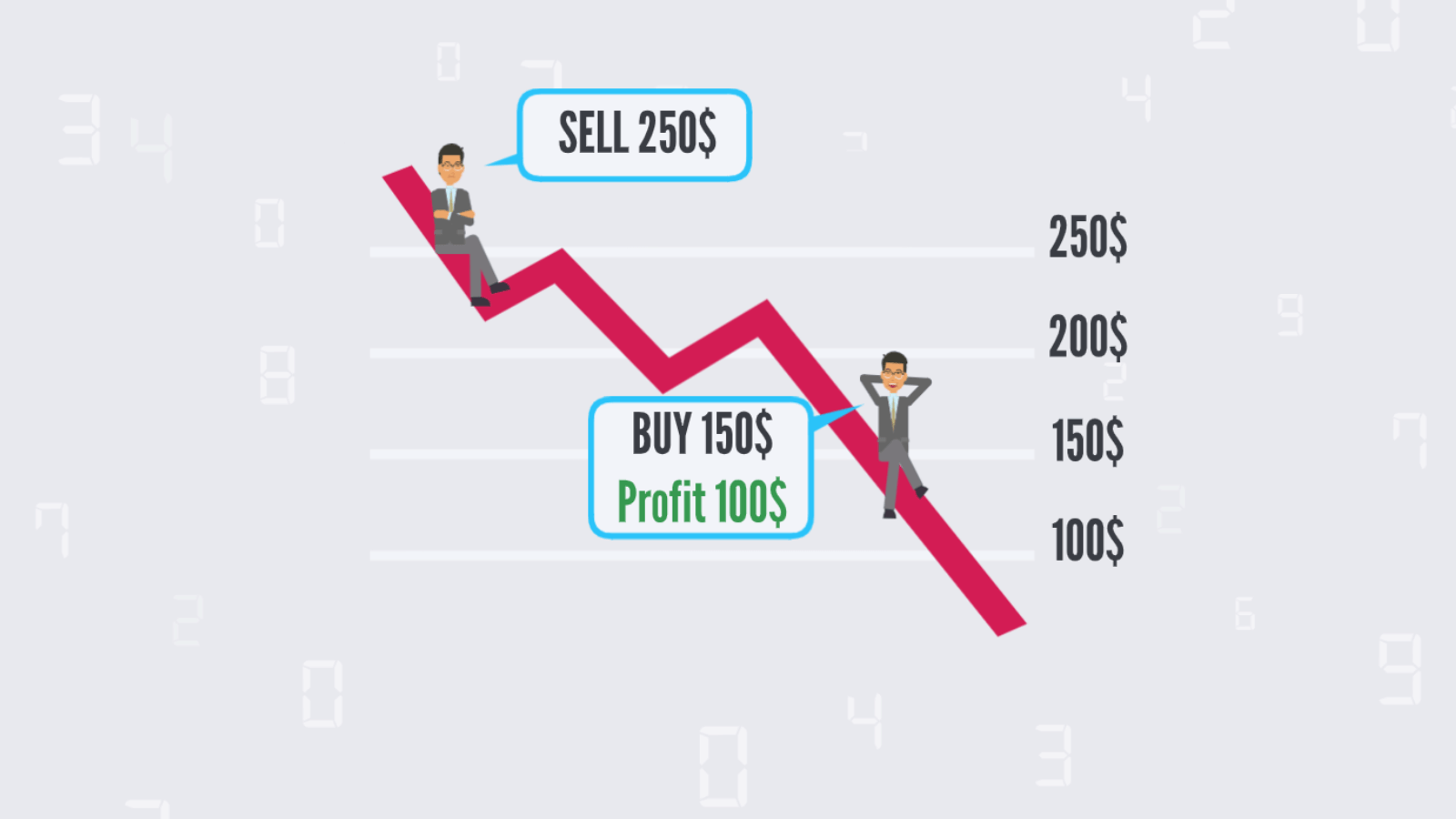

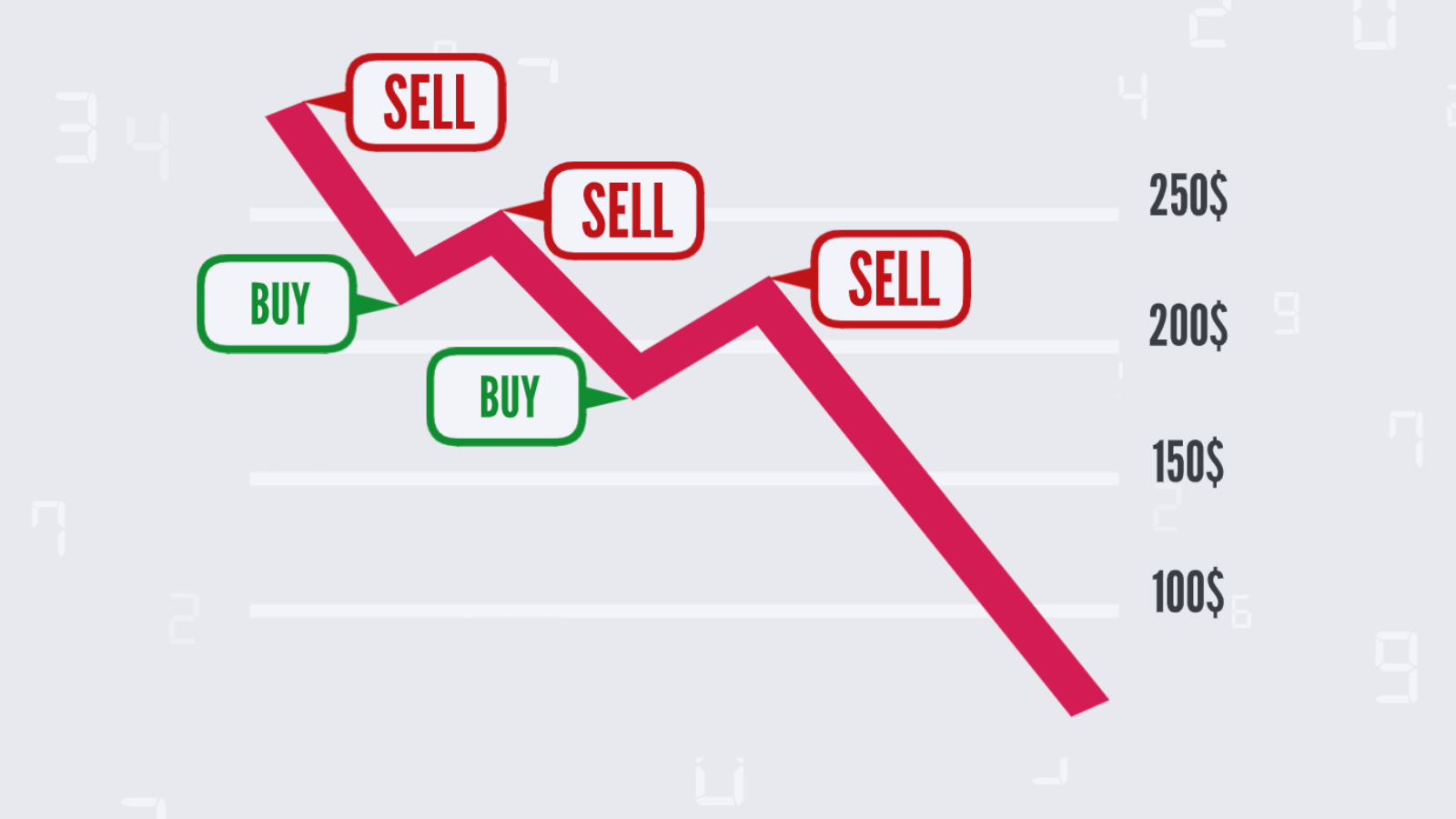

Traders will try to understand whether the demand for these funds will grow in order to buy them right now cheaper and then sell more expensive.

A mechanism called shorting or short selling involves selling securities without owning them. With it, traders will try to sell shares before losing in value, to buy them later at a lower price.

There are a huge number of methods for determining when and how much the price of a particular share will change.

For example, traders can turn to financial reports, analytics on the goods or services they produce, forecasts of growth or decline, the business environment, price charts. In general – to whatever you can turn to, to at least roughly understand how the balance of supply and demand will change, and therefore the price.

Stock Trading on Financial Markets is Conducted through Brokers

Traders cannot trade stocks among themselves or buy them directly from the company. To be precise, direct purchase is possible, but this is no longer related to stock markets, that is, to the topic of our lesson.

Traders need to go to the stock markets to buy and sell shares, and access to the market is provided by a broker.

Short-Term or Long-Term Trading

In online trading, you can open deals for the price to rise or fall and keep these orders open as long as you like. Some prefer to keep orders open for months, and even years, and others make hundreds of trades a day for a few seconds. Whether it’s better to keep a trade open for a long time or not is determined individually by each trader.

Short-Term Trading

Traders who prefer short-term deals usually use mainly technical analysis (based on the study of charts), as on small terms this method of analytics is more accurate than fundamental analysis (based on macroeconomic data). After all, macroeconomic indicators are not so relevant to rely on them within one trading day.

But it cannot be said that fundamental data are not taken into account in short-term trading, because the release of important news and indicators can quickly change the value of an asset, providing the trader with an opportunity for income.

Long-Term Trading

When trading over a long period of time, traders pay more attention to the fundamental data about the company in order to have an idea of future price trends. For example, if the demand for a company’s shares does not fall, the trend towards their price increase is likely to continue to rise.

At the same time, long-term traders rely a lot on technical analysis, since over long periods it does not lose its effectiveness and can serve as an additional tool.